($$$MR. MARKET$$$ is a proprietary investor and does not provide individual financial advice. The stocks mentioned on this forum do not represent individual buy or sell recommendations and should not be viewed as such. Individual investors should consider speaking with a professional investment adviser before making any investment decisions.)

It’s been a while since it had made sense for my stock picking model to generate potential winners consisting of companies that have growing revenue and earnings, are establishing new highs and are still affordable. The continued hiking of rates is idiotic, given that the cumulative lag affect of these rate hikes won’t be seen for another 12 – 18 months, so the reaction by the Fed to weekly news is completely unnecessary. Having said that, applications for US unemployment benefits jumped last week to the highest level since October 2021, suggesting mounting layoff announcements may be starting to translate into job cuts. This kind of news may be enough to give the Fed some pause on rate hikes, which should really be rocket fuel for homebuilders.

Despite all of the macro headwinds, we’re starting to see traces of bullishness returning. The haters are gonna hate, but right now the stocks that look pretty attractive are the homebuilders. There just aren’t enough houses out there right now to meet demand, despite these higher interest rates. Homebuilder stocks are doing really well in 2023, as the U.S. housing market tightens. An already undersupplied housing market is seeing strong demand especially for new homes, as fewer existing houses enter the market amid rising interest and mortgage rates. What’s happening is that existing home owners don’t want to sell, because their existing mortgage rates are so low. So the remaining source of supply is new homes and that’s why home builders are looking attractive. The U.S. is in a long-term housing shortage, with the construction of new homes failing to keep pace with the growing population. The US is undersupplied by about 6 million homes and this will take a long time to catch up. New home sales improved for the fifth straight month.

So what’s the next winning pick? We thought you’d never ask. Today I bought M/I Homes, Inc. (NYSE:MHO) at 75.86. I will sell it in 4 to 6 weeks at 87.62. Here’s why I like MHO.

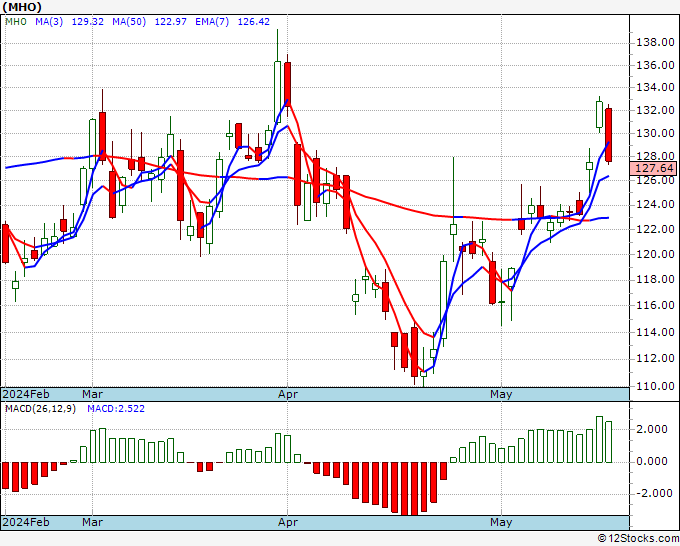

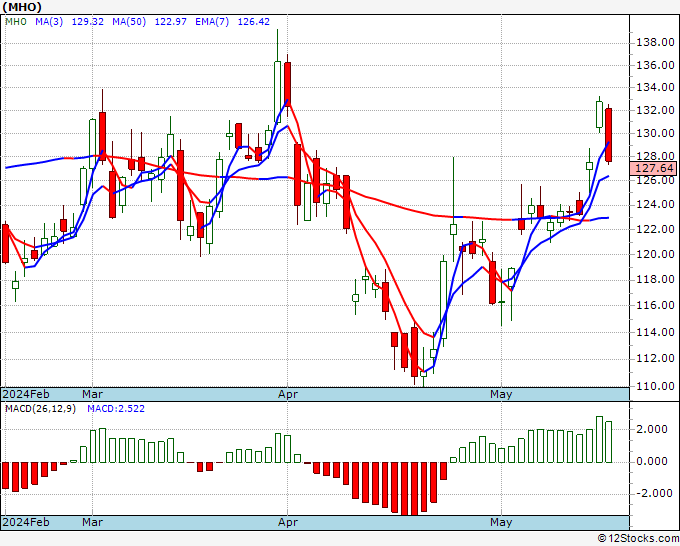

Take a look at this amazing chart. MHO has certainly been on a rampage over the last 52 weeks, going up by 90% and yet, it’s PE is only 4.2. I mean that’s crazy crazy cheap. With earnings not coming out until later next month, there’s a good chance MHO hits my target before earnings release! What is fueling this stock price climb?

Many companies in this space are trading up by 40% to 80% from their October lows, when sentiment towards the housing industry was at a low point. Remember, people are always entitled to their own opinions but no one is entitled to their own facts. The fact of the matter is that these companies are earnings machines and MHO is printing money while it’s stock price remains an incredible value. The lack of housing inventory has been a boon for housing prices, 28% of which are selling above their listing prices. When people want to pay more than asking price, that’s a pretty good widget to be producing. Existing home sales fell for 12 straight months through January 2023, which represented a new record, and potential buyers increasingly backed out of deals. That shaved billions of dollars in value off the 21 Largest Home Builders in USA, which measures home building stocks by market cap. That’s what caused these companies to be oversold.

That said, there are undoubtedly some good housing stocks to buy given some of the more encouraging signs in the market, including record low inventory and rising orders. Mortgage rates have also been on the downswing of late, making homes more affordable than they’ve been for a long time. MHO is particularly attractive. There was a 21% jump in hedge fund ownership of M/I Homes during Q1, pushing the stock to an all-time high. For the fourth quarter, M/I Homes hit record revenue of $1.22 billion and grew its operating margin by 1.4 percentage points to 25.7%. As mortgage rates pull back the positive demographics and lack of housing supply over the past 10 years provides a very favorable long-term supply/demand picture for the industry. M/I Homes’ attractive asset base, strong balance sheet and ongoing valuation discount to peers should provide an attractive long-term reward/risk investment opportunity.

MHO has an impressive record of positive earnings surprises. In its last earnings report on April 26, 2023, M/I Homes reported EPS of $3.64 versus consensus estimate of $2.36. ANAL-ysts are projecting earnings of $12.40 per share on $3.71 billion in revenues for the existing fiscal year. For the next fiscal year, the company is expected to earn $13.17 per share on $3.91 billion in revenues. These earnings are robust. Think about it, if the PE multiple ever expands to 8 (which is still pretty cheap), this stock price would be over $100. The peer industry average multiple is 9.2, so there is room on the runway for MHO.

If you want to look at some metrics, MHO has an ROCE of 20%. That’s a pretty good return and MHO has continued to reinvest their capital, to fuel growth. Right now, the Home Builders industry is in the top 10% of all the industries that the ANAL-ysts categorize, so they have some nice tailwinds. Operating margins are running at 15% and Return on Equity is 25%. What we have is a strong company that has a lot of momentum that is still very very cheap. I’ll take a combination of value and growth any day. That’s why I’m all in on MHO.

I am HUGE!

www.mrmarketishuge.com

It’s been a while since it had made sense for my stock picking model to generate potential winners consisting of companies that have growing revenue and earnings, are establishing new highs and are still affordable. The continued hiking of rates is idiotic, given that the cumulative lag affect of these rate hikes won’t be seen for another 12 – 18 months, so the reaction by the Fed to weekly news is completely unnecessary. Having said that, applications for US unemployment benefits jumped last week to the highest level since October 2021, suggesting mounting layoff announcements may be starting to translate into job cuts. This kind of news may be enough to give the Fed some pause on rate hikes, which should really be rocket fuel for homebuilders.

Despite all of the macro headwinds, we’re starting to see traces of bullishness returning. The haters are gonna hate, but right now the stocks that look pretty attractive are the homebuilders. There just aren’t enough houses out there right now to meet demand, despite these higher interest rates. Homebuilder stocks are doing really well in 2023, as the U.S. housing market tightens. An already undersupplied housing market is seeing strong demand especially for new homes, as fewer existing houses enter the market amid rising interest and mortgage rates. What’s happening is that existing home owners don’t want to sell, because their existing mortgage rates are so low. So the remaining source of supply is new homes and that’s why home builders are looking attractive. The U.S. is in a long-term housing shortage, with the construction of new homes failing to keep pace with the growing population. The US is undersupplied by about 6 million homes and this will take a long time to catch up. New home sales improved for the fifth straight month.

So what’s the next winning pick? We thought you’d never ask. Today I bought M/I Homes, Inc. (NYSE:MHO) at 75.86. I will sell it in 4 to 6 weeks at 87.62. Here’s why I like MHO.

Take a look at this amazing chart. MHO has certainly been on a rampage over the last 52 weeks, going up by 90% and yet, it’s PE is only 4.2. I mean that’s crazy crazy cheap. With earnings not coming out until later next month, there’s a good chance MHO hits my target before earnings release! What is fueling this stock price climb?

Many companies in this space are trading up by 40% to 80% from their October lows, when sentiment towards the housing industry was at a low point. Remember, people are always entitled to their own opinions but no one is entitled to their own facts. The fact of the matter is that these companies are earnings machines and MHO is printing money while it’s stock price remains an incredible value. The lack of housing inventory has been a boon for housing prices, 28% of which are selling above their listing prices. When people want to pay more than asking price, that’s a pretty good widget to be producing. Existing home sales fell for 12 straight months through January 2023, which represented a new record, and potential buyers increasingly backed out of deals. That shaved billions of dollars in value off the 21 Largest Home Builders in USA, which measures home building stocks by market cap. That’s what caused these companies to be oversold.

That said, there are undoubtedly some good housing stocks to buy given some of the more encouraging signs in the market, including record low inventory and rising orders. Mortgage rates have also been on the downswing of late, making homes more affordable than they’ve been for a long time. MHO is particularly attractive. There was a 21% jump in hedge fund ownership of M/I Homes during Q1, pushing the stock to an all-time high. For the fourth quarter, M/I Homes hit record revenue of $1.22 billion and grew its operating margin by 1.4 percentage points to 25.7%. As mortgage rates pull back the positive demographics and lack of housing supply over the past 10 years provides a very favorable long-term supply/demand picture for the industry. M/I Homes’ attractive asset base, strong balance sheet and ongoing valuation discount to peers should provide an attractive long-term reward/risk investment opportunity.

MHO has an impressive record of positive earnings surprises. In its last earnings report on April 26, 2023, M/I Homes reported EPS of $3.64 versus consensus estimate of $2.36. ANAL-ysts are projecting earnings of $12.40 per share on $3.71 billion in revenues for the existing fiscal year. For the next fiscal year, the company is expected to earn $13.17 per share on $3.91 billion in revenues. These earnings are robust. Think about it, if the PE multiple ever expands to 8 (which is still pretty cheap), this stock price would be over $100. The peer industry average multiple is 9.2, so there is room on the runway for MHO.

If you want to look at some metrics, MHO has an ROCE of 20%. That’s a pretty good return and MHO has continued to reinvest their capital, to fuel growth. Right now, the Home Builders industry is in the top 10% of all the industries that the ANAL-ysts categorize, so they have some nice tailwinds. Operating margins are running at 15% and Return on Equity is 25%. What we have is a strong company that has a lot of momentum that is still very very cheap. I’ll take a combination of value and growth any day. That’s why I’m all in on MHO.

I am HUGE!

www.mrmarketishuge.com

Comment