($$$MR. MARKET$$$ is a proprietary investor and does not provide individual financial advice. The stocks mentioned on this forum do not represent individual buy or sell recommendations and should not be viewed as such. Individual investors should consider speaking with a professional investment adviser before making any investment decisions.)

It seems like a long time ago, but 2020 brought our economy to a grinding halt, minimizing consumption of goods. Of course all of the production that was on its way to market got all backed up. So manufacturers had to trim back, or in many cases, shut down completely. Then what happened? The economy snapped back and demand came back, but supply was overwhelmed and production couldn’t come back online fast enough. It was a supply chain disaster of epic proportions. Clearly there was a need for a predictive solution. Manufacturing executives knew that there had to be a software solution that would do a better job of controlling inventory. Enter machine learning and Artificial Intelligence. Yep – AI. Imagine if there was a company that sold these software solutions to wanting companies? Imagine no more…enter Celestica.

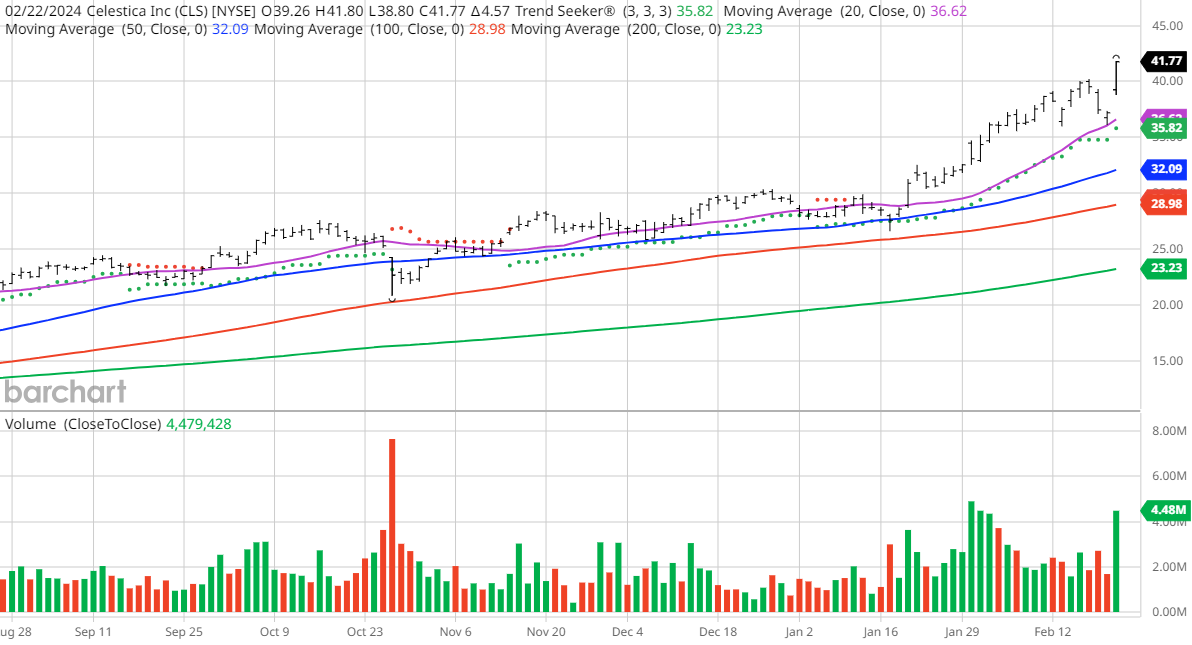

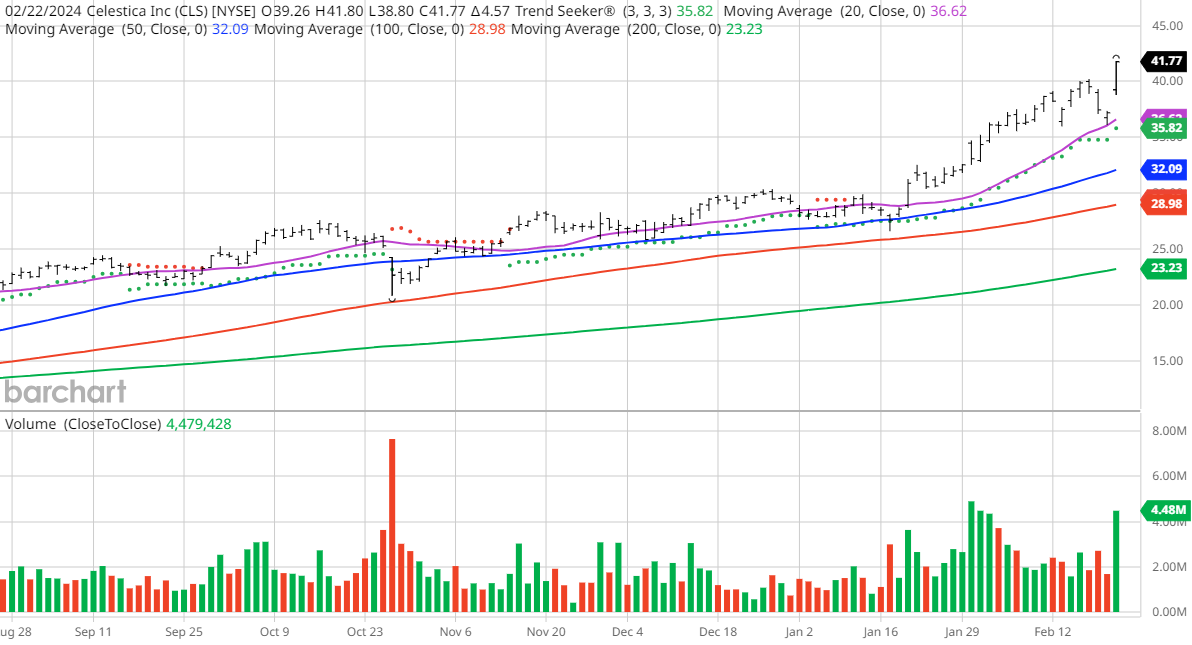

Today I bought Celestica (CLS) at 45.48. I will sell it in 4 – 6 weeks at 52.53. Here’s why I like CLS:

This stock is up 303% in the last 12 months and yet its PE is only 23. Why is this stock doing so well? It’s because they are making money hand over fist, and nothing is going to stop it! Celestica Inc. is a global leader in the field of design, manufacturing, and supply chain solutions for the world's most innovative companies. Celestica enables the world's best brands. They partner with leading companies in Aerospace and Defense, Communications, Enterprise, HealthTech, Industrial, and Capital Equipment to deliver solutions for their most complex challenges. They are the industry leader in design, manufacturing, hardware platform and supply chain solutions. Once they help a customer, they have that customer for life with repeat business leading to even more revenues from the same customer. The company is making so much money, they are buying back shares like crazy – it’s like steroids for the stock price.

CLS has industry tailwinds at its back. IT demand is showing signs of recovery, fueled by mounting interest in generative AI. With greater acceptance of transformative technologies generative AI is poised to become a huge industry driver. The tech sector outperformed in 2023, with a gain of 56.4% compared to a gain of 24.2% for the S&P 500.

Just look at the numbers:

“We are pleased with our solid fourth quarter results. We had a strong finish to 2023 and achieved 10% revenue growth for the full year compared to 2022” said Rob Mionis, President and CEO, Celestica. “The strong momentum we had in 2023 is continuing into 2024 and we remain confident in our long term strategy”.

Q4 2023 Highlights

Hyperscaler clouds are designed to be highly available and have a large number of data centers located around the globe, which can mean more redundancy for your cloud application if it's hosted across data centers. Celestica has captured growth in their hyperscaler customer offering which should lead to some real outsized revenue growth as well. The company projects for 2024 to have revenue exceed $8.5 billion with EPS to be $2.70 or more. Clearly they will likely exceed $3.00 share when all is said and done, and with a PE of 23, that takes the stock price to 69 which is well past my target sale price. Hyperscaler indeed.

The demand for artificial intelligence and cloud based solutions is increasing exponentially. CLS is in the thick of all of this. As their customers demand more AI applications, CLS will be there to fill those roles. Look what the boss had to say, “At Celestica, we recognize that our employees play an important role in our company’s success and we strive to create a collaborative environment that fosters innovation, empowers people and leverages individual expertise.” They are stealing the smart kids away from Google, Amazon and Facebook. The future is bright.

Yet the value is still there, despite the incredible stock price ascent already. Don’t forget momentum…that always helps propel the stock higher and may lead to PE expansion.

Celestica's forward P/S is 0.75, which is well below the industry average, so it’s quite a bargain compared to some other techy shops. The cash flow that CLS is spewing reinforces this valuation. Keep in perspective its strong balance sheet as well. Total Debt/Equity (mrq) is 44.26%. The Q1 2024 outlook for CLS is surprisingly strong, indicating a potential growth of 60% in EPS. Management has already declared guidance of 18% growth this quarter. Of course they will beat that, and continue to grow through the year. Remember, this isn’t some tiny startup wooing angel investors. It’s an 8 billion dollar company, soon to be $10 billion with a market cap of almost $6 billion. They are already the bull of the woods.

It’s hard to be humble when you’re this successful. Here’s the boss, “We anticipate this solid growth to continue in 2024 and believe that this investment cycle has the potential to support several years of strong demand for our CCS segment. The demand outlook for our enterprise and market continues to be impressive as the beneficiary of hyperscaler's growing deployment of AI/ML compute capacity. We're seeing the strong momentum from 2023 continue, and as mentioned earlier, we anticipate significant growth within our AI/ML compute portfolio as we enter 2024. We expect additional growth in our storage business to materialize in the latter half of the year, driven by demand from new programs. We feel that our positioning for 2024 remains positive, as we remain confident in our ability to meet our financial outlook and improve on our very strong performance in 2023.”

I don’t need Chat GPT to tell me to buy this stock…I’m all in and can’t wait to take it to the pay window!

$$$MR. MARKET$$$

www.mrmarketishuge.com

It seems like a long time ago, but 2020 brought our economy to a grinding halt, minimizing consumption of goods. Of course all of the production that was on its way to market got all backed up. So manufacturers had to trim back, or in many cases, shut down completely. Then what happened? The economy snapped back and demand came back, but supply was overwhelmed and production couldn’t come back online fast enough. It was a supply chain disaster of epic proportions. Clearly there was a need for a predictive solution. Manufacturing executives knew that there had to be a software solution that would do a better job of controlling inventory. Enter machine learning and Artificial Intelligence. Yep – AI. Imagine if there was a company that sold these software solutions to wanting companies? Imagine no more…enter Celestica.

Today I bought Celestica (CLS) at 45.48. I will sell it in 4 – 6 weeks at 52.53. Here’s why I like CLS:

This stock is up 303% in the last 12 months and yet its PE is only 23. Why is this stock doing so well? It’s because they are making money hand over fist, and nothing is going to stop it! Celestica Inc. is a global leader in the field of design, manufacturing, and supply chain solutions for the world's most innovative companies. Celestica enables the world's best brands. They partner with leading companies in Aerospace and Defense, Communications, Enterprise, HealthTech, Industrial, and Capital Equipment to deliver solutions for their most complex challenges. They are the industry leader in design, manufacturing, hardware platform and supply chain solutions. Once they help a customer, they have that customer for life with repeat business leading to even more revenues from the same customer. The company is making so much money, they are buying back shares like crazy – it’s like steroids for the stock price.

CLS has industry tailwinds at its back. IT demand is showing signs of recovery, fueled by mounting interest in generative AI. With greater acceptance of transformative technologies generative AI is poised to become a huge industry driver. The tech sector outperformed in 2023, with a gain of 56.4% compared to a gain of 24.2% for the S&P 500.

Just look at the numbers:

“We are pleased with our solid fourth quarter results. We had a strong finish to 2023 and achieved 10% revenue growth for the full year compared to 2022” said Rob Mionis, President and CEO, Celestica. “The strong momentum we had in 2023 is continuing into 2024 and we remain confident in our long term strategy”.

Q4 2023 Highlights

- Revenue: $2.14 billion, increased 5% compared to $2.04 billion for the fourth quarter of 2022 (Q4 2022).

- Adjusted earnings per share (EPS) (non-IFRS)*: $0.76, compared to $0.56 for Q4 2022.

- Adjusted return on invested capital (adjusted ROIC) (non-IFRS)*: 23.3%, compared to 20.7% for Q4 2022.

- Adjusted free cash flow (non-IFRS)*: $83.8 million, compared to $42.6 million for Q4 2022.

- EPS: $0.70 compared to $0.35 for Q4 2022.

Hyperscaler clouds are designed to be highly available and have a large number of data centers located around the globe, which can mean more redundancy for your cloud application if it's hosted across data centers. Celestica has captured growth in their hyperscaler customer offering which should lead to some real outsized revenue growth as well. The company projects for 2024 to have revenue exceed $8.5 billion with EPS to be $2.70 or more. Clearly they will likely exceed $3.00 share when all is said and done, and with a PE of 23, that takes the stock price to 69 which is well past my target sale price. Hyperscaler indeed.

The demand for artificial intelligence and cloud based solutions is increasing exponentially. CLS is in the thick of all of this. As their customers demand more AI applications, CLS will be there to fill those roles. Look what the boss had to say, “At Celestica, we recognize that our employees play an important role in our company’s success and we strive to create a collaborative environment that fosters innovation, empowers people and leverages individual expertise.” They are stealing the smart kids away from Google, Amazon and Facebook. The future is bright.

Yet the value is still there, despite the incredible stock price ascent already. Don’t forget momentum…that always helps propel the stock higher and may lead to PE expansion.

Celestica's forward P/S is 0.75, which is well below the industry average, so it’s quite a bargain compared to some other techy shops. The cash flow that CLS is spewing reinforces this valuation. Keep in perspective its strong balance sheet as well. Total Debt/Equity (mrq) is 44.26%. The Q1 2024 outlook for CLS is surprisingly strong, indicating a potential growth of 60% in EPS. Management has already declared guidance of 18% growth this quarter. Of course they will beat that, and continue to grow through the year. Remember, this isn’t some tiny startup wooing angel investors. It’s an 8 billion dollar company, soon to be $10 billion with a market cap of almost $6 billion. They are already the bull of the woods.

It’s hard to be humble when you’re this successful. Here’s the boss, “We anticipate this solid growth to continue in 2024 and believe that this investment cycle has the potential to support several years of strong demand for our CCS segment. The demand outlook for our enterprise and market continues to be impressive as the beneficiary of hyperscaler's growing deployment of AI/ML compute capacity. We're seeing the strong momentum from 2023 continue, and as mentioned earlier, we anticipate significant growth within our AI/ML compute portfolio as we enter 2024. We expect additional growth in our storage business to materialize in the latter half of the year, driven by demand from new programs. We feel that our positioning for 2024 remains positive, as we remain confident in our ability to meet our financial outlook and improve on our very strong performance in 2023.”

I don’t need Chat GPT to tell me to buy this stock…I’m all in and can’t wait to take it to the pay window!

$$$MR. MARKET$$$

www.mrmarketishuge.com

Comment