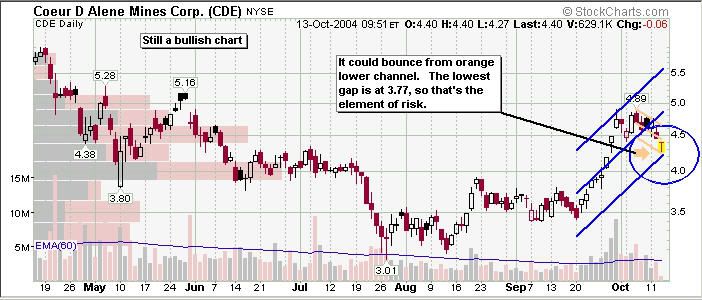

CDE:

Chart has given me an exit signal - daily channel turn down - and with those gaps down there, I'd rather step aside and waid for risk to improve for another entry.

Closed long position today at 4.60 for +$0.94 or 25.7% profit.

Chart has given me an exit signal - daily channel turn down - and with those gaps down there, I'd rather step aside and waid for risk to improve for another entry.

Closed long position today at 4.60 for +$0.94 or 25.7% profit.

Comment