One of the best things about the United States is the fact that one of our US territories is Puerto Rico. This wonderful little tropical island houses many rich treasures. Throughout history this little island has raised some men who became giants. Not as HUGE as $$$MR. MARKET$$$ of course, but giants in their own right.

Who could ever forget the great Tito Puente . He formed what became the Tito Puente Orchestra and became a leader of the mambo and cha-cha-cha fads in the 1950s and for the next five decades helped define Latin jazz in the United States.

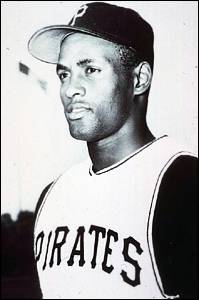

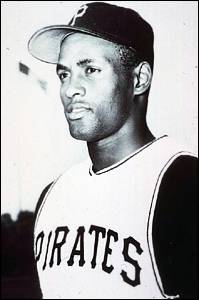

or how about the epitome of class and grace, the great great Roberto Clemente:

Born in Carolina on August 18. He was a baseball player with the Pittsburgh Pirates (1955-1972), he compiled a lifetime batting average of .317, hit 240 home runs and was considered baseball's premier defensive outfielder. Clemente won four National League batting titles (1961, 1964, 1965, 1966). He was the league's Most Valuable Player in 1966 and was selected to the All-Star team 12 times. He also won 12 Gold Glove awards as the NL's premier right fielder, and he was frequently cited by experts as having the best outfielder's throwing arm they had ever seen. After he obtained his 3,000th hit in the last game of the 1972 season, his life was tragically cut short when an airplane loaded with supplies for earthquake victims in Managua, Nicaragua, crashed off the Puerto Rican coast. He was elected to the Hall of Fame in 1973.

Just when you think they can’t build them any bigger, the most famous Puerto Rican of all changed the very fabric of Americana. Yes, I’m talking about the one and only Pedro Morales:

Of the numerous Latino pro wrestlers to have competed in North America -- men like Jose Lothario, The Guerrero Family, Al Perez, Gino Hernandez, Pepper Gomez, and so many other greats from "south of the border" -- Pedro Morales is perhaps the most famous and successful of them all. As a beloved multi-time World champion and main event performer, Morales was a role model for millions. A man with ample "cross-over appeal," Morales was a hero not only to his fellow Latin Americans, but also to wrestling's vast North American fanbase. A top box office draw throughout the 1960's, 1970's, and into the 1980's, Pedro Morales was one of the most in-demand performers of his era, and a true Hall of Fame legend.

Who can ever forget Pedro’s captivating interviews when he asked Vince McMahon if he could say a few words to his Spanish speaking friends before facing evil doers such as Bulldog Brower, Stan Stasiak, Joe Turko, Chuck Richards, the Wolfman, and Moon Dog Main. When I was a kid living in our summer house in Pocasset, MA, my next door neighbor there looked like Pedro Morales. So we used to call him Pedro. He did not know why. One day he built a rail fence and we asked him if he was going to stand on top of the railing and jump down on his wife. He was not amused.

As transformational as Pedro was, the new kid in town are the financial service companies emanating from Puerto Rico. You may recall Doral (DRL) , #20 in my amazing string of 54 consecutive profitable trades of 15% or better. Although DRL may have held superstar status not unlike that of Pedro Morales, there is indeed a new kid in town. Take a look:

Little Oriental Financial Group (OFG) is blowing the doors off of Doral. Just like Pedro Morales used to beat down Professor Toru Tanaka. As a result, OFG is the new $$$MR. MARKET$$$ winner. Today I bought OFG at 31.91. I will sell it in 4 to 6 weeks at 36.93. Here’s why I like OFG:

Oriental Financial group, Inc.. The Group's principal activity is to provide broad range of banking services with a network of 21 branch offices in San Juan, Puerto Rico. The Group provides mortgage, commercial and consumer lending, saving and time deposit products, financial planning, insurance sales, money management and investment brokerage services. So how did we end up with an Oriental bank in Puerto Rico? Oriental, through predecessor entities, was founded on the Eastern side of Puerto Rico and "Eastern" in Spanish is "Oriental." But of course! Now go to a cocktail party with this tidbit and impress your friends!

OFG’s stock is up 66% in the last 52 weeks. What is incredibly attractive is that fact that its P/E is only 13.4. I’m buying incredibly strong price momentum at a very safe earnings multiple. There’s no place for this stock to fall but up! So you look at the one year chart and you say, “Wait a minute, $$$MR. MARKET$$$ is on acid. The 52 week r^2 correlation coefficient is only 0.66!!”. This is true, but sometimes you have to drill down a little. The 6 month, 3 month and 6 week r^2 values are 0.89, 0.89 and 0.93, respectively. OFG is on the hunt! It’s all about earnings earnings earnings. OFG is growing its earnings at a rate of 17%, compared to the industry average of 6%.

With $5.7 billion in total assets (FY03), Oriental has generated more than 17% compound annual net income growth for the last five years (FY99-03), producing the highest ROE among publicly traded Puerto Rico banks and one of the highest ROE’s among publicly traded mid-tier banks ($1-$15 billion in assets). Typically for financial services companies, I focus on a high return-on-equity , and look for a return-on-asset ratio above 1%. Considering the dollar volumes of loans or assets the bank has, this measure is a good benchmark. OFG has a ROA of 1.9%. Doral has an ROE of 30%, OFG laughs in its face with an ROE of 41%. It also holds a dominant position among the Puerto Rican community, which is growing and getting wealthier. With a PE of 13 this company is extremely cheap and has fantastic upside.

Oriental Financial Group, is more a diversified financial holding company than a traditional bank or thrift. "We are not a normal bank," says Pedro Ortega, investor relations manager. While Oriental provides a full range of consumer banking services, it specializes in trust, money management, financial planning, investment, brokerage and mortgage origination services. It began diversifying a few years ago when Jose E. Fernandez, who had been a successful broker, became CEO.

Last quarter, OFG reported a 25.4 percent increase in net income

for the second fiscal quarter ended on December 31, 2003. Net income for the quarter rose to $15.7 million, compared with $12.5 million for the corresponding three-month period in fiscal 2003. Earnings per diluted share increased to $0.70 for the quarter, up 18.6 percent from $0.59 for the corresponding period in the previous fiscal year.

Moreover, return on equity (ROE) rose sharply in the second quarter to

41.28 percent from 31.25 percent in the same quarter a year earlier, a 32.1 percent gain. Industry average for ROE is 17%.

Results for the first six months of the current fiscal year represent a

net income increase to $29.2 million, up 21.4 percent from the $24.1 million earned in the same six-month period in fiscal 2003. Earnings per share (fully diluted) rose to $1.33 for the first half of the current fiscal year, a 17.7 percent increase from the $1.13 earned per fully diluted share in the first half of fiscal 2003.

The gain from other income sources, such as service fees and the sale of securities, continued to be an important factor in the second quarter and the first six months of fiscal 2004. Total non-interest income reached $9.4 million in the second quarter of fiscal 2004, compared with $8.6 million in the same fiscal 2003 quarter, an increase of 8.9 percent. For the six-month period, total non-interest income was $22.3 million in fiscal 2004, against $16.2 million in fiscal 2003, up 38.0 percent.

Total financial assets managed and owned increased 22.7 percent to

$6.1 billion from $5.0 billion at the end of the year-ago quarter and grew by 4.9 percent from $5.8 billion at the end of the first quarter.

Deposits increased 13.3 percent to $1,077.8 million as of December 31, 2003, compared to $951.3 million as of December 31, 2002, and rose 7.1 percent from $1,006.7 million as of September 30, 2003. Deposits benefited from the success of Oriental's program to attract accounts and larger deposits from professional customers.

Borrowings as of December 31, 2003 increased 32.1 percent to $1,993.8 million as compared with $1,509.4 million as of December 31, 2002,

and 8.7 percent from $1,834.1 million as of September 30, 2003.

In November 2003, Oriental increased its quarterly cash dividend by

10 percent and also declared a 10 percent stock dividend on its common shares.

Forward EPS estimates reflect the strong 2003 results and the expectation of a better than earlier anticipated net interest margin going forward. Currently, OFG trades at a significant discount based on almost all trading multiples. Oriental Financial is the most profitable in its sector. The company’s strategy to integrate all aspects of customer financial planning makes it unique among its peers.

Why is OFG doing so well? The results of its 2004 Customer Satisfaction Survey, highlighted by an 89 percent overall customer satisfaction rate. Customer satisfaction for the categories Employee Courtesy, Employee Knowledge of Products and Services, Customer Access to Information, and Accuracy of Financial Statements -- were 97 percent, 93 percent, 92 percent and 94 percent, respectively. Survey results also indicated that 93 percent of customers plan to continue doing business with the Company, and that 92 percent would recommend using Oriental.

"We are extremely pleased with these results and, compared to the historically lower levels of banking customer satisfaction in Puerto Rico generally, find them especially compelling," said Rene Colon, VP of Customer Service. "This survey shows that not only has our customer

base grown in size, but also in loyalty, thanks in part to our determination to instill throughout Oriental a vigorous customer-centered approach. We are also very pleased that this effort

is reflected with more customers than ever before considering Oriental their primary banking institution."

Oriental Financial Group’s recent acquisition of Caribbean Pension Consultants (CPC), a third-party administrator of pension plans in the U.S., Puerto Rico, and several other Caribbean markets, really will expand OFG’s market reach. "This foothold in the U.S. mainland market will enable Oriental to serve its existing clients more efficiently and to take advantage of new business opportunities, both in the States and in Puerto Rico. We expect the new subsidiary will contribute positively to expanding the fee income for the group. It also fits our corporate strategy for business development through new and improved product and service lines that are geared to meeting the total financial requirements of clients.”

ANALysts project that OFG will record fiscal year 2004 earnings of $2.73/share. $$$MR. MARKET$$$ is laughing so very hard into his tropical drink. The last time I was in Puerto Rico, I took all of the quatloops from the casino. Regardless, OFG will actually earn $2.84/share to close out the fiscal year. Even at the ridiculously low P/E of 13.4, this gets you to a share price of $38.06 which is well past my sell target. Even better, even those timid ANALysts peg the 2005 earnings at $3.07/share which would equal a share price of $41.14 at the same valuation multiple. If you use the more appropriate earnings multiple of 15.5 which R&G Financial Corp carries, you end up with a share price of $47.59. Now we’re talking hot salsa!

If you analyze the true value of the business, OFG looks even more attractive. If we assume initial earnings of $56.5 million grow at a rate of 12.00%, and we discount those future earnings at a rate of 15.00%, we arrive at a net present value for the company's next 10 years of earnings of $490 million. To account for potential earnings beyond the 10th year, we estimate a growth rate of 6.00%, a discount rate of 12.00%, and we arrive at a continuing value of $766 million. To complete the calculation we add these two figures together, subtract the long-term debt for OFG ($87.2 million), and divide by the outstanding shares (19.8 million) to get a per share intrinsic value of $59.09. As Ric Flair, who wrestled Carlos Colon in Puerto Rico, would say – Whoooooooooooooo!

Sometimes $$$MR. MARKET$$$ likes to steal free information from VectorVest. Here’s what those nerds had to say about OFG:

VectorVest favors the purchase of stocks with RV ratings above 1.00. Vector Vest’s Relative Value (RV) for OFG is 1.28. Turning back to momentum, is OFG’s Relative Timing.

RT (Relative Timing): RT is a fast, smart, accurate indicator of a stock's price trend. OFG has a Relative Timing rating of 1.40, which is excellent on a scale of 0.00 to 2.00. RT is computed from an analysis of the direction, magnitude, and dynamics of a stock's price movements over one day, one week, one quarter and one year time periods. Once a stock's price has established a strong trend, it is expected to continue in that trend for the short-term. If a trend dissipates, RT will gravitate toward 1.00. VectorVest favors the purchase of stocks with RT ratings above 1.00.

DY (Dividend Yield): DY reflects earnings per share as a percent of Price. OFG has a Dividend Yield of 1.9%. This is above the current average of 1.2% for all the stocks in the VectorVest database. DY equals 100 x (DIV/Price).

DG (Dividend Growth Rate): Dividend Growth is a subtle yet important indicator of a company's financial performance. It also provides some insight into the board's outlook on the company's ability to increase earnings. OFG has a Dividend Growth of 9% This is above the current average of 2% for all the stocks in the VectorVest database.

There is a lot of great free analysis on the internet. Everything is free. $$$MR. MARKET$$$ is free. That’s why I go commando, everything is free.

Oriental Financial Group is winning the game when it comes to operating performance. It’s Return on Invested Capital is 20.4%, compared to Industry Average of 6.9%. Post-tax Profit Margin is an incredible 26.9% compared to the Industry Average of 18.2%. Price/Cash Flow is 9.3 vs. Industry Average of 13.8. If Wall Street would adjust OFG’s Price to Cash Flow to reflect Industry Average on this basis, OFG’s share price would be $47.34. I’m starting to think Industry Average is like the Washington Generals, that team that always loses to the Harlem Globetrotters.

The two largest institutional shareholders of OFG are Barclays Bank (3.26%) and Fleet Boston (2.13%). One would think that these major moneycenter banks know a good little bank when they see one. I guess they do. Of course the largest shareholder is Jose Enrique Fernandez, the CEO with 17.6% of the shares. As Jose goes, so goes Oriental.

His interests are aligned with mine. I wonder if he is a Pedro Morales fan?

Look at these performance ratios:

Metric OFG Peer Mean

ROAA% 1.88 1.10 1.06

ROAE% 27.91 12.95 13.15

Efficiency Ratio% 38.11 62.51 61.55

In fact Oriental Financial Group describes itself as a financial institution that has broken the mold. Take its moniker, for instance, which doesn’t sound much like the name of a commercial bank: Oriental Group/Financial Planners.

OFG sees their role not as transaction bankers who open accounts and move money but as financial advisers who bring money-management techniques to the financial requirements of clients. The proof is evident: Using data warehousing, a handful of off-the-shelf Microsoft tools, and Internet/intranet technologies, today Oriental can produce a 360-degree view of every customer. Reports are available directly to staffers and to customers via Oriental’s Internet sites, OrientalOnline and BankingForCDs.com. Detailed paper reports are available as well, and are affixed with bar codes so return mail can be quickly and automatically flagged for follow-up. What? You think they keep customers by giving them a drink with a little umbrella in it?

Over the years, banks have spent millions of dollars on technologies that promised to deliver a detailed snapshot of customers. Few banks really know what to do with it,. Oriental, is the exception to that rule, because it uses data warehousing and intranet technologies extremely effectively. In this way it has learned to manage customer relationships across the information silos that have sprung forth as it has grown and diversified. It allows them to isolate rifle-shot targets with respect to marketing products and services.

Among the measurements of success: The bank found that the percentage of past-IRA deposit-making customers who also made IRA deposits had doubled since the previous tax season. And while the bank’s dependency on new customers fell. Oriental nevertheless saw a 17% increase in its customer portfolio. Management believes the opportunities for continued successes from Oriental’s data warehouse and complementary technology investments are almost limitless. Our organization has traditionally been recognized as a standard in IRAs," said Juan Jose Santiago, Oriental Financial Group’s senior vice president & trust officer. "Although Oriental has made available an extensive menu of IRA options, the Puerto Rico Growth Fund, with its 29.85% yield last year, continues to be attractive to all customers."

The CEO plans to continue diversifying the company. Oriental received permission from the Fed to become a financial holding company, and through that vehicle expects to step up its insurance distribution business. Oriental has been selling annuities for years and recently started selling life insurance.

In a few years, Oriental expects to get into real estate management. Its newest and most ambitious project is the launch of an Internet bank aimed at Latin America. Its first product will be equity-indexed certificates of deposit.

So we have a great little bank in Puerto Rico that makes money. How do you really know that its earnings will continue to grow? Take a look at the island itself. So the economy goes, so goes OFG.

Sales are up; hotels are booked; construction is back in gear and businesses are starting to rehire. The economic recovery is finally here. After two years of dashed hopes for most local industries, with the notable exception of the banking and finance industries, businesspeople on the island are starting to sense the sweet smell of recovery. 2004 will be a good year for Puerto Rico’s economy. Local economists agree, most of them pinning growth this year at between 3% and 4%. Typically the economy of Puerto Rico mirrors, but lags a little behind, that of the U.S. economy. With last Friday’s jobs report, there can be no doubt that we are well on our way. What the local economy does seem to have in common with the overall national economy is fairly strong consumer confidence.

The U.S. manufacturing industry has picked up considerably in the past few months. Since Puerto Rico’s economy depends heavily on the manufacturing industry—it accounts for approximately 42% of the island’s gross domestic product—the strengthening of the industry stateside, will give the local economy a boost.

On the tourism front, occupancy rates in December were fairly high and this trend should hold up through the spring. These days, U.S. mainland tourists are less willing to go to Europe and more willing to come to Puerto Rico because the security restrictions, and associated angst, are much fewer . The importance of Greenie’s recent statements that he intends to keep interest rates pretty much where they are now will have a positive effect on the construction industry and on businesses’ capital expenditures on equipment and machinery.

The consensus among top executives in Puerto Rico’s financial industry is that positive news out of the U.S. mainland economy will lead to a banner year locally in 2004. A stronger economy in 2004 should yield faster growth in loans and deposits, contributing to the overall economic recovery. The New Year has the makings of a solid year, given the strength of the past two quarters in the U.S. economy. The stock market has appreciated and consumer confidence has improved greatly. Loan delinquencies should go down and an expansion in the consumer areas should materialize. Puerto Rico is becoming a safe haven of choice for drug manufacturers (and I’m talking about the legal kind).

Several manufacturing companies have announced new expansions or will finish expansions and product transfers in 2004. In Juncos, Medtronic Med-Rel Inc. just announced a new $50 million expansion to its soon-to-be inaugurated $35 million plant, increasing the size of the operation from 102,000 square feet to 120,000 square feet and adding 200 jobs to its current work force of 400. Before the end of 2003, Amgen doubled its $400 million biotechnology-plant expansion, also in Juncos, adding another 500,000 square feet and 200 jobs. By 2005, Amgen will provide more than 1,000 jobs.

Abbott Laboratories’ $350 million biotechnology plant is scheduled to be completed on time and on budget by October 2004, with a work force of 200. The new 310,000-square-foot operation will bring to Puerto Rico the production of Humira, a treatment for rheumatoid arthritis. Gurabo’s Johnson & Johnson (J&J) Janssen-Ortho LLC pharmaceutical drug manufacturing facility will be working on a $250 million expansion that will create 125 jobs by the time it is ready in 2006.

Construction on Eli Lilly’s $450 million biotechnology plant in Carolina is slated to be finished in late 2004 or early 2005, when the federal regulatory validation process could start; operations could then begin in 2006. The current pharmaceutical facility in Carolina will undergo a $175 million expansion for a fill-and-finish facility, the final stage for pipeline products such as Symbyax, PKC, Cymbalta, and Yentreve, which are pending regulatory approval. Eli Lilly is also building a new $125 million state-of-the-art bulk manufacturing facility in Mayaguez to produce Strattera, a new nonstimulant-treatment for attention deficit disorder, expanding the complex’s work force from 300 to 450.

The fundamentals scream for OFG. Here’s what the charts say. Some indicators that look very favorable are the 7 Day Average, 20 day Moving Average vs. Price and the 20 – 50 Day MACD Oscillator, 50 Day Moving Average vs. Price, the 20 – 100 Day MACD Oscillator, the 50 Day Parabolic Time/Price, the 60 Day Commodity Channel Index, the 100 Day Moving Average vs. Price and the 50 – 100 Day MACD Oscillator.

Just today, OFG announced a new online information site so that Institutional Investors can learn more about them. With 17.6% of the stock, you can be sure Jose E. Fernandez, President, Chairman and Chief Executive Officer of Oriental is watching all of these like a hawk. He probably has his eyes glued to the screen and when his secretary walks in, he throws his shoe at her so he doesn’t get distracted. Here’s what he had to say:

"Our ability to continue to manage assets and liabilities in a profitable manner, while building our core profit centers for current and future growth, was the primary factor in achieving the results for the second quarter and the first six months of fiscal 2004," said Jose E. Fernandez, President, Chairman and Chief Executive Officer of Oriental. "These outstanding results outperform our peers in Puerto Rico and place Oriental among the top performing U.S. banks with assets in the $1 billion to $5 billion range, as well," Mr. Fernandez noted.

"The steady gain in interest income, growth in fee income and the ability to continue to attract trust and broker-dealer assets strengthen our belief that Oriental will meet or exceed expectations for profitability in the second half offiscal 2004," Mr. Fernandez said. Oh how nice that our 17.6% swami is giving $$$MR. MARKET$$$ a little look see. What else does he have to say?

"We are encouraged by the new commercial business that is currently in the pipeline," Mr. Fernandez said, "as well as the spin-offs that are being developed from the emphasis on building relationships with other products, such as financial planning, investments, mortgages, insurance, credit cards and deposit accounts. Our core profit centers made important contributions to the increase in earnings as we moved ahead aggressively with our plan to diversify the asset mix by building interest-income revenue sources as well as noninterest revenue streams. We are confident that Oriental’s concentration on core business growth and its careful expansion of the loan portfolio will contribute to further earnings growth in fiscal 2004.”

Wow! He said it again. He sounds like someone who owns a lot of shares of this company. I wonder who he was rooting for in the epic Shea Stadium battle between Bruno Sammartino and Pedro Morales. Does anyone know who won that match??

All of this Puerto Rico talk has made me crave the beer drinking, cigar smoking, high stakes action only the Titans can generate at the high roller blackjack table. That’s right, the Titans will be together again in Atlantic City in only a few weeks. Surely the walls will crumble as these two pillars of the planet join forces once again to divide and conquer. Doubling hard 12’s and doing the wall – the Titans are back!

I am HUGE!!

Who could ever forget the great Tito Puente . He formed what became the Tito Puente Orchestra and became a leader of the mambo and cha-cha-cha fads in the 1950s and for the next five decades helped define Latin jazz in the United States.

or how about the epitome of class and grace, the great great Roberto Clemente:

Born in Carolina on August 18. He was a baseball player with the Pittsburgh Pirates (1955-1972), he compiled a lifetime batting average of .317, hit 240 home runs and was considered baseball's premier defensive outfielder. Clemente won four National League batting titles (1961, 1964, 1965, 1966). He was the league's Most Valuable Player in 1966 and was selected to the All-Star team 12 times. He also won 12 Gold Glove awards as the NL's premier right fielder, and he was frequently cited by experts as having the best outfielder's throwing arm they had ever seen. After he obtained his 3,000th hit in the last game of the 1972 season, his life was tragically cut short when an airplane loaded with supplies for earthquake victims in Managua, Nicaragua, crashed off the Puerto Rican coast. He was elected to the Hall of Fame in 1973.

Just when you think they can’t build them any bigger, the most famous Puerto Rican of all changed the very fabric of Americana. Yes, I’m talking about the one and only Pedro Morales:

Of the numerous Latino pro wrestlers to have competed in North America -- men like Jose Lothario, The Guerrero Family, Al Perez, Gino Hernandez, Pepper Gomez, and so many other greats from "south of the border" -- Pedro Morales is perhaps the most famous and successful of them all. As a beloved multi-time World champion and main event performer, Morales was a role model for millions. A man with ample "cross-over appeal," Morales was a hero not only to his fellow Latin Americans, but also to wrestling's vast North American fanbase. A top box office draw throughout the 1960's, 1970's, and into the 1980's, Pedro Morales was one of the most in-demand performers of his era, and a true Hall of Fame legend.

Who can ever forget Pedro’s captivating interviews when he asked Vince McMahon if he could say a few words to his Spanish speaking friends before facing evil doers such as Bulldog Brower, Stan Stasiak, Joe Turko, Chuck Richards, the Wolfman, and Moon Dog Main. When I was a kid living in our summer house in Pocasset, MA, my next door neighbor there looked like Pedro Morales. So we used to call him Pedro. He did not know why. One day he built a rail fence and we asked him if he was going to stand on top of the railing and jump down on his wife. He was not amused.

As transformational as Pedro was, the new kid in town are the financial service companies emanating from Puerto Rico. You may recall Doral (DRL) , #20 in my amazing string of 54 consecutive profitable trades of 15% or better. Although DRL may have held superstar status not unlike that of Pedro Morales, there is indeed a new kid in town. Take a look:

Little Oriental Financial Group (OFG) is blowing the doors off of Doral. Just like Pedro Morales used to beat down Professor Toru Tanaka. As a result, OFG is the new $$$MR. MARKET$$$ winner. Today I bought OFG at 31.91. I will sell it in 4 to 6 weeks at 36.93. Here’s why I like OFG:

Oriental Financial group, Inc.. The Group's principal activity is to provide broad range of banking services with a network of 21 branch offices in San Juan, Puerto Rico. The Group provides mortgage, commercial and consumer lending, saving and time deposit products, financial planning, insurance sales, money management and investment brokerage services. So how did we end up with an Oriental bank in Puerto Rico? Oriental, through predecessor entities, was founded on the Eastern side of Puerto Rico and "Eastern" in Spanish is "Oriental." But of course! Now go to a cocktail party with this tidbit and impress your friends!

OFG’s stock is up 66% in the last 52 weeks. What is incredibly attractive is that fact that its P/E is only 13.4. I’m buying incredibly strong price momentum at a very safe earnings multiple. There’s no place for this stock to fall but up! So you look at the one year chart and you say, “Wait a minute, $$$MR. MARKET$$$ is on acid. The 52 week r^2 correlation coefficient is only 0.66!!”. This is true, but sometimes you have to drill down a little. The 6 month, 3 month and 6 week r^2 values are 0.89, 0.89 and 0.93, respectively. OFG is on the hunt! It’s all about earnings earnings earnings. OFG is growing its earnings at a rate of 17%, compared to the industry average of 6%.

With $5.7 billion in total assets (FY03), Oriental has generated more than 17% compound annual net income growth for the last five years (FY99-03), producing the highest ROE among publicly traded Puerto Rico banks and one of the highest ROE’s among publicly traded mid-tier banks ($1-$15 billion in assets). Typically for financial services companies, I focus on a high return-on-equity , and look for a return-on-asset ratio above 1%. Considering the dollar volumes of loans or assets the bank has, this measure is a good benchmark. OFG has a ROA of 1.9%. Doral has an ROE of 30%, OFG laughs in its face with an ROE of 41%. It also holds a dominant position among the Puerto Rican community, which is growing and getting wealthier. With a PE of 13 this company is extremely cheap and has fantastic upside.

Oriental Financial Group, is more a diversified financial holding company than a traditional bank or thrift. "We are not a normal bank," says Pedro Ortega, investor relations manager. While Oriental provides a full range of consumer banking services, it specializes in trust, money management, financial planning, investment, brokerage and mortgage origination services. It began diversifying a few years ago when Jose E. Fernandez, who had been a successful broker, became CEO.

Last quarter, OFG reported a 25.4 percent increase in net income

for the second fiscal quarter ended on December 31, 2003. Net income for the quarter rose to $15.7 million, compared with $12.5 million for the corresponding three-month period in fiscal 2003. Earnings per diluted share increased to $0.70 for the quarter, up 18.6 percent from $0.59 for the corresponding period in the previous fiscal year.

Moreover, return on equity (ROE) rose sharply in the second quarter to

41.28 percent from 31.25 percent in the same quarter a year earlier, a 32.1 percent gain. Industry average for ROE is 17%.

Results for the first six months of the current fiscal year represent a

net income increase to $29.2 million, up 21.4 percent from the $24.1 million earned in the same six-month period in fiscal 2003. Earnings per share (fully diluted) rose to $1.33 for the first half of the current fiscal year, a 17.7 percent increase from the $1.13 earned per fully diluted share in the first half of fiscal 2003.

The gain from other income sources, such as service fees and the sale of securities, continued to be an important factor in the second quarter and the first six months of fiscal 2004. Total non-interest income reached $9.4 million in the second quarter of fiscal 2004, compared with $8.6 million in the same fiscal 2003 quarter, an increase of 8.9 percent. For the six-month period, total non-interest income was $22.3 million in fiscal 2004, against $16.2 million in fiscal 2003, up 38.0 percent.

Total financial assets managed and owned increased 22.7 percent to

$6.1 billion from $5.0 billion at the end of the year-ago quarter and grew by 4.9 percent from $5.8 billion at the end of the first quarter.

Deposits increased 13.3 percent to $1,077.8 million as of December 31, 2003, compared to $951.3 million as of December 31, 2002, and rose 7.1 percent from $1,006.7 million as of September 30, 2003. Deposits benefited from the success of Oriental's program to attract accounts and larger deposits from professional customers.

Borrowings as of December 31, 2003 increased 32.1 percent to $1,993.8 million as compared with $1,509.4 million as of December 31, 2002,

and 8.7 percent from $1,834.1 million as of September 30, 2003.

In November 2003, Oriental increased its quarterly cash dividend by

10 percent and also declared a 10 percent stock dividend on its common shares.

Forward EPS estimates reflect the strong 2003 results and the expectation of a better than earlier anticipated net interest margin going forward. Currently, OFG trades at a significant discount based on almost all trading multiples. Oriental Financial is the most profitable in its sector. The company’s strategy to integrate all aspects of customer financial planning makes it unique among its peers.

Why is OFG doing so well? The results of its 2004 Customer Satisfaction Survey, highlighted by an 89 percent overall customer satisfaction rate. Customer satisfaction for the categories Employee Courtesy, Employee Knowledge of Products and Services, Customer Access to Information, and Accuracy of Financial Statements -- were 97 percent, 93 percent, 92 percent and 94 percent, respectively. Survey results also indicated that 93 percent of customers plan to continue doing business with the Company, and that 92 percent would recommend using Oriental.

"We are extremely pleased with these results and, compared to the historically lower levels of banking customer satisfaction in Puerto Rico generally, find them especially compelling," said Rene Colon, VP of Customer Service. "This survey shows that not only has our customer

base grown in size, but also in loyalty, thanks in part to our determination to instill throughout Oriental a vigorous customer-centered approach. We are also very pleased that this effort

is reflected with more customers than ever before considering Oriental their primary banking institution."

Oriental Financial Group’s recent acquisition of Caribbean Pension Consultants (CPC), a third-party administrator of pension plans in the U.S., Puerto Rico, and several other Caribbean markets, really will expand OFG’s market reach. "This foothold in the U.S. mainland market will enable Oriental to serve its existing clients more efficiently and to take advantage of new business opportunities, both in the States and in Puerto Rico. We expect the new subsidiary will contribute positively to expanding the fee income for the group. It also fits our corporate strategy for business development through new and improved product and service lines that are geared to meeting the total financial requirements of clients.”

ANALysts project that OFG will record fiscal year 2004 earnings of $2.73/share. $$$MR. MARKET$$$ is laughing so very hard into his tropical drink. The last time I was in Puerto Rico, I took all of the quatloops from the casino. Regardless, OFG will actually earn $2.84/share to close out the fiscal year. Even at the ridiculously low P/E of 13.4, this gets you to a share price of $38.06 which is well past my sell target. Even better, even those timid ANALysts peg the 2005 earnings at $3.07/share which would equal a share price of $41.14 at the same valuation multiple. If you use the more appropriate earnings multiple of 15.5 which R&G Financial Corp carries, you end up with a share price of $47.59. Now we’re talking hot salsa!

If you analyze the true value of the business, OFG looks even more attractive. If we assume initial earnings of $56.5 million grow at a rate of 12.00%, and we discount those future earnings at a rate of 15.00%, we arrive at a net present value for the company's next 10 years of earnings of $490 million. To account for potential earnings beyond the 10th year, we estimate a growth rate of 6.00%, a discount rate of 12.00%, and we arrive at a continuing value of $766 million. To complete the calculation we add these two figures together, subtract the long-term debt for OFG ($87.2 million), and divide by the outstanding shares (19.8 million) to get a per share intrinsic value of $59.09. As Ric Flair, who wrestled Carlos Colon in Puerto Rico, would say – Whoooooooooooooo!

Sometimes $$$MR. MARKET$$$ likes to steal free information from VectorVest. Here’s what those nerds had to say about OFG:

VectorVest favors the purchase of stocks with RV ratings above 1.00. Vector Vest’s Relative Value (RV) for OFG is 1.28. Turning back to momentum, is OFG’s Relative Timing.

RT (Relative Timing): RT is a fast, smart, accurate indicator of a stock's price trend. OFG has a Relative Timing rating of 1.40, which is excellent on a scale of 0.00 to 2.00. RT is computed from an analysis of the direction, magnitude, and dynamics of a stock's price movements over one day, one week, one quarter and one year time periods. Once a stock's price has established a strong trend, it is expected to continue in that trend for the short-term. If a trend dissipates, RT will gravitate toward 1.00. VectorVest favors the purchase of stocks with RT ratings above 1.00.

DY (Dividend Yield): DY reflects earnings per share as a percent of Price. OFG has a Dividend Yield of 1.9%. This is above the current average of 1.2% for all the stocks in the VectorVest database. DY equals 100 x (DIV/Price).

DG (Dividend Growth Rate): Dividend Growth is a subtle yet important indicator of a company's financial performance. It also provides some insight into the board's outlook on the company's ability to increase earnings. OFG has a Dividend Growth of 9% This is above the current average of 2% for all the stocks in the VectorVest database.

There is a lot of great free analysis on the internet. Everything is free. $$$MR. MARKET$$$ is free. That’s why I go commando, everything is free.

Oriental Financial Group is winning the game when it comes to operating performance. It’s Return on Invested Capital is 20.4%, compared to Industry Average of 6.9%. Post-tax Profit Margin is an incredible 26.9% compared to the Industry Average of 18.2%. Price/Cash Flow is 9.3 vs. Industry Average of 13.8. If Wall Street would adjust OFG’s Price to Cash Flow to reflect Industry Average on this basis, OFG’s share price would be $47.34. I’m starting to think Industry Average is like the Washington Generals, that team that always loses to the Harlem Globetrotters.

The two largest institutional shareholders of OFG are Barclays Bank (3.26%) and Fleet Boston (2.13%). One would think that these major moneycenter banks know a good little bank when they see one. I guess they do. Of course the largest shareholder is Jose Enrique Fernandez, the CEO with 17.6% of the shares. As Jose goes, so goes Oriental.

His interests are aligned with mine. I wonder if he is a Pedro Morales fan?

Look at these performance ratios:

Metric OFG Peer Mean

ROAA% 1.88 1.10 1.06

ROAE% 27.91 12.95 13.15

Efficiency Ratio% 38.11 62.51 61.55

In fact Oriental Financial Group describes itself as a financial institution that has broken the mold. Take its moniker, for instance, which doesn’t sound much like the name of a commercial bank: Oriental Group/Financial Planners.

OFG sees their role not as transaction bankers who open accounts and move money but as financial advisers who bring money-management techniques to the financial requirements of clients. The proof is evident: Using data warehousing, a handful of off-the-shelf Microsoft tools, and Internet/intranet technologies, today Oriental can produce a 360-degree view of every customer. Reports are available directly to staffers and to customers via Oriental’s Internet sites, OrientalOnline and BankingForCDs.com. Detailed paper reports are available as well, and are affixed with bar codes so return mail can be quickly and automatically flagged for follow-up. What? You think they keep customers by giving them a drink with a little umbrella in it?

Over the years, banks have spent millions of dollars on technologies that promised to deliver a detailed snapshot of customers. Few banks really know what to do with it,. Oriental, is the exception to that rule, because it uses data warehousing and intranet technologies extremely effectively. In this way it has learned to manage customer relationships across the information silos that have sprung forth as it has grown and diversified. It allows them to isolate rifle-shot targets with respect to marketing products and services.

Among the measurements of success: The bank found that the percentage of past-IRA deposit-making customers who also made IRA deposits had doubled since the previous tax season. And while the bank’s dependency on new customers fell. Oriental nevertheless saw a 17% increase in its customer portfolio. Management believes the opportunities for continued successes from Oriental’s data warehouse and complementary technology investments are almost limitless. Our organization has traditionally been recognized as a standard in IRAs," said Juan Jose Santiago, Oriental Financial Group’s senior vice president & trust officer. "Although Oriental has made available an extensive menu of IRA options, the Puerto Rico Growth Fund, with its 29.85% yield last year, continues to be attractive to all customers."

The CEO plans to continue diversifying the company. Oriental received permission from the Fed to become a financial holding company, and through that vehicle expects to step up its insurance distribution business. Oriental has been selling annuities for years and recently started selling life insurance.

In a few years, Oriental expects to get into real estate management. Its newest and most ambitious project is the launch of an Internet bank aimed at Latin America. Its first product will be equity-indexed certificates of deposit.

So we have a great little bank in Puerto Rico that makes money. How do you really know that its earnings will continue to grow? Take a look at the island itself. So the economy goes, so goes OFG.

Sales are up; hotels are booked; construction is back in gear and businesses are starting to rehire. The economic recovery is finally here. After two years of dashed hopes for most local industries, with the notable exception of the banking and finance industries, businesspeople on the island are starting to sense the sweet smell of recovery. 2004 will be a good year for Puerto Rico’s economy. Local economists agree, most of them pinning growth this year at between 3% and 4%. Typically the economy of Puerto Rico mirrors, but lags a little behind, that of the U.S. economy. With last Friday’s jobs report, there can be no doubt that we are well on our way. What the local economy does seem to have in common with the overall national economy is fairly strong consumer confidence.

The U.S. manufacturing industry has picked up considerably in the past few months. Since Puerto Rico’s economy depends heavily on the manufacturing industry—it accounts for approximately 42% of the island’s gross domestic product—the strengthening of the industry stateside, will give the local economy a boost.

On the tourism front, occupancy rates in December were fairly high and this trend should hold up through the spring. These days, U.S. mainland tourists are less willing to go to Europe and more willing to come to Puerto Rico because the security restrictions, and associated angst, are much fewer . The importance of Greenie’s recent statements that he intends to keep interest rates pretty much where they are now will have a positive effect on the construction industry and on businesses’ capital expenditures on equipment and machinery.

The consensus among top executives in Puerto Rico’s financial industry is that positive news out of the U.S. mainland economy will lead to a banner year locally in 2004. A stronger economy in 2004 should yield faster growth in loans and deposits, contributing to the overall economic recovery. The New Year has the makings of a solid year, given the strength of the past two quarters in the U.S. economy. The stock market has appreciated and consumer confidence has improved greatly. Loan delinquencies should go down and an expansion in the consumer areas should materialize. Puerto Rico is becoming a safe haven of choice for drug manufacturers (and I’m talking about the legal kind).

Several manufacturing companies have announced new expansions or will finish expansions and product transfers in 2004. In Juncos, Medtronic Med-Rel Inc. just announced a new $50 million expansion to its soon-to-be inaugurated $35 million plant, increasing the size of the operation from 102,000 square feet to 120,000 square feet and adding 200 jobs to its current work force of 400. Before the end of 2003, Amgen doubled its $400 million biotechnology-plant expansion, also in Juncos, adding another 500,000 square feet and 200 jobs. By 2005, Amgen will provide more than 1,000 jobs.

Abbott Laboratories’ $350 million biotechnology plant is scheduled to be completed on time and on budget by October 2004, with a work force of 200. The new 310,000-square-foot operation will bring to Puerto Rico the production of Humira, a treatment for rheumatoid arthritis. Gurabo’s Johnson & Johnson (J&J) Janssen-Ortho LLC pharmaceutical drug manufacturing facility will be working on a $250 million expansion that will create 125 jobs by the time it is ready in 2006.

Construction on Eli Lilly’s $450 million biotechnology plant in Carolina is slated to be finished in late 2004 or early 2005, when the federal regulatory validation process could start; operations could then begin in 2006. The current pharmaceutical facility in Carolina will undergo a $175 million expansion for a fill-and-finish facility, the final stage for pipeline products such as Symbyax, PKC, Cymbalta, and Yentreve, which are pending regulatory approval. Eli Lilly is also building a new $125 million state-of-the-art bulk manufacturing facility in Mayaguez to produce Strattera, a new nonstimulant-treatment for attention deficit disorder, expanding the complex’s work force from 300 to 450.

The fundamentals scream for OFG. Here’s what the charts say. Some indicators that look very favorable are the 7 Day Average, 20 day Moving Average vs. Price and the 20 – 50 Day MACD Oscillator, 50 Day Moving Average vs. Price, the 20 – 100 Day MACD Oscillator, the 50 Day Parabolic Time/Price, the 60 Day Commodity Channel Index, the 100 Day Moving Average vs. Price and the 50 – 100 Day MACD Oscillator.

Just today, OFG announced a new online information site so that Institutional Investors can learn more about them. With 17.6% of the stock, you can be sure Jose E. Fernandez, President, Chairman and Chief Executive Officer of Oriental is watching all of these like a hawk. He probably has his eyes glued to the screen and when his secretary walks in, he throws his shoe at her so he doesn’t get distracted. Here’s what he had to say:

"Our ability to continue to manage assets and liabilities in a profitable manner, while building our core profit centers for current and future growth, was the primary factor in achieving the results for the second quarter and the first six months of fiscal 2004," said Jose E. Fernandez, President, Chairman and Chief Executive Officer of Oriental. "These outstanding results outperform our peers in Puerto Rico and place Oriental among the top performing U.S. banks with assets in the $1 billion to $5 billion range, as well," Mr. Fernandez noted.

"The steady gain in interest income, growth in fee income and the ability to continue to attract trust and broker-dealer assets strengthen our belief that Oriental will meet or exceed expectations for profitability in the second half offiscal 2004," Mr. Fernandez said. Oh how nice that our 17.6% swami is giving $$$MR. MARKET$$$ a little look see. What else does he have to say?

"We are encouraged by the new commercial business that is currently in the pipeline," Mr. Fernandez said, "as well as the spin-offs that are being developed from the emphasis on building relationships with other products, such as financial planning, investments, mortgages, insurance, credit cards and deposit accounts. Our core profit centers made important contributions to the increase in earnings as we moved ahead aggressively with our plan to diversify the asset mix by building interest-income revenue sources as well as noninterest revenue streams. We are confident that Oriental’s concentration on core business growth and its careful expansion of the loan portfolio will contribute to further earnings growth in fiscal 2004.”

Wow! He said it again. He sounds like someone who owns a lot of shares of this company. I wonder who he was rooting for in the epic Shea Stadium battle between Bruno Sammartino and Pedro Morales. Does anyone know who won that match??

All of this Puerto Rico talk has made me crave the beer drinking, cigar smoking, high stakes action only the Titans can generate at the high roller blackjack table. That’s right, the Titans will be together again in Atlantic City in only a few weeks. Surely the walls will crumble as these two pillars of the planet join forces once again to divide and conquer. Doubling hard 12’s and doing the wall – the Titans are back!

I am HUGE!!

Comment