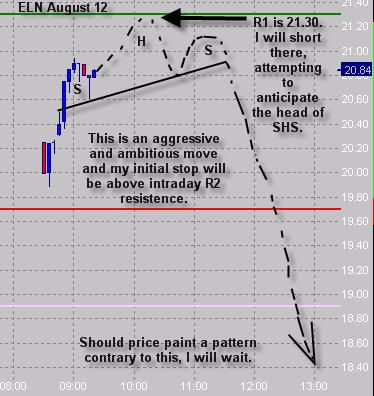

Stopped out ELN over HOD for insignificant loss - gotta love those tight stops. I'll look to reenter on a intraday pattern.

Spike's Scientific Stock Analysis

Collapse

X

-

Thanks, spike. Good luck to you too.

I didnt have a lot of luck recently with my short trades. I got stopped out a couple of times. The good thing was that I didnt lose much money, but I also watched the stocks go down a couple of points after I got stopped out. I still need to learn how to enter at a better place. This time I gave more room to my trade (my stop is 20.30). Wish me luck.

Another question. Do you take volume into account when you short this stock? The volume is very good today.

Comment

-

-

Good Luck with it.Originally posted by yaoyaoThanks, spike. Good luck to you too.

I didnt have a lot of luck recently with my short trades. I got stopped out a couple of times. The good thing was that I didnt lose much money, but I also watched the stocks go down a couple of points after I got stopped out. I still need to learn how to enter at a better place. This time I gave more room to my trade (my stop is 20.30). Wish me luck.

Another question. Do you take volume into account when you short this stock? The volume is very good today.

As per previous post, I'm out already and waiting to get anther entry. I do this often enough to know that looking for entries requires both patience and discipline. It's never easy, but the good thing is my pain is always very low. The times I get a perfect entry and nice run is what makes up for all the little stops.

I do consider volume by price, yes.

Comment

-

-

Yep...I think you may be right Spike.Originally posted by spikefaderGod may be telling you something.Originally posted by WebsmanLooks like I'll have to hold off on any buys this week...I'm right in the middle of the path of Tropical storm Bonnie.

Oh well....it's the price you pay for living in paradise!

Keep your head down!

Keep your head down! I did well by staying out of the market today.

I did well by staying out of the market today.

I think I'll wait for DHB to fill that gap before I try to go long. There's not many good longs right now.

I would short OFG, but my broker doesn't offer that option. I have the advantage of trading tax free through a "457" account but I miss out on being able to short. It's good not having to pay IRS anything though.

Anyone want to come to a hurricane party tomorrow???

Comment

-

-

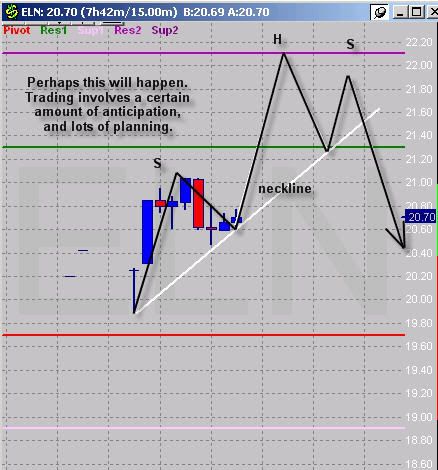

I understand what you're saying. A stop out always feels terrible - since you've been PROVEN wrong and have to admit defeat. Nobody enjoys that, especially when money is involved. But the only way to succeed in this game is to accept losses as a normal part of the picture. Just accept that they are going to happen, and if you accept that, you must aim to make them as small as humanly possible, so that you can live to trade another day. And the only way to make them as small as humanly possible is to look for setups where you enter at a double bottom or top (or near to it) and have a stop just the other side of the low or high. That's a tight stop that a skilled trader would use, and if you get taken out, then the setup is invalid and you have no reason to be in the trade anyway. The next best is anticipating the right shoulder of a SHS, with stop above the head. And then a neckline break and so on....wedges or simply S1 S2 R1 R2 or pivot, with stops at the nearest point possible. Sure, you'll get stopped out a lot, but they are small. And when you nail the perfect entry, you're smiling from the start and can enjoy the ride for as many points as you can reasonably target. Say you have 10 stop outs for 10 cents each on a $20 stock. That's only a point. And say you nail the 11th entry and you ride it for 5 points....you're up 4 points less commissions of course, and that's excellent. Your success rate is only 10%, but you're way ahead. So number of successes isn't the important thing....it's the losses that make the difference. See, in this business, the person who loses the best will win, not the person who wins the best but can't control losses for whatever reason, whether it be poor management, too wide stops, blowing stops by getting undisciplined and watching in horror as your losses keep getting worse and worse and worse.Originally posted by yaoyaoGot stopped out again. Now I wish I had a tighter stop. It requires a very good trading skill not to be stopped out within 10-20c. I hope I could have that skills some day.

Anyway, enough ranting. I hope that's helpful to someone

Comment

-

-

Good to see it working for ya. Not to rain on your parade, but just FYI, I'll be looking for another ELN short tomorrow IF a good pattern reveals itself. 2 good days of strength to short into, at resistence, and who knows what she'll do.Originally posted by kingofthehillELAN BABY >>>> up 10 percent today

http://dynamic.nasdaq.com/aspx/mosta...amp;afterhour=

On the bullish side, perhaps if she sells a little over the next two days, you'll have an inverted SHS setting up........we'll see anyway

Comment

-

-

Spike, thanks for your excellent writing. I've been stopped out 4 times in a row, but since I use tight stops (not as tight as yours), I didn't lose much money. I dont feel so terrible being stopped out now. I'm learning from each trade, and am getting better at charting reading. Thanks again for sharing your chart analysis and trading experience.

Comment

-

-

I'm Back and READY to LEARN

Good Day Spick, how has the market been treating you. Back from Colo. Vac. and found some new interests. The first one on my list is UTSI. Now there is a story to look at. If a person liked to fish the bottom would you consider this the bottom or is there room for this one to go lower. Another one I would like for you to look at would be FTO. This one is also on a downward turn. Where do you feel a good entry point might be.

Spent some time playing in Stock Charts tonight, Tool Bar is real cool, now just have to figure out what it all means on a chart. Thanks In Advance ===> MEAGO BIG RED!!!!!

Comment

-

-

Re: I'm Back and READY to LEARN

Hi Mea. Hope you enjoyed the Vac.Originally posted by MEA_1956Good Day Spick, how has the market been treating you. Back from Colo. Vac. and found some new interests. The first one on my list is UTSI. Now there is a story to look at. If a person liked to fish the bottom would you consider this the bottom or is there room for this one to go lower. Another one I would like for you to look at would be FTO. This one is also on a downward turn. Where do you feel a good entry point might be.

Spent some time playing in Stock Charts tonight, Tool Bar is real cool, now just have to figure out what it all means on a chart. Thanks In Advance ===> MEA

UTSI is very sick. I wouldn't go long if I were you:

previous posted charts: http://img.photobucket.com/albums/v1...UTSIweekly.jpg

Today it's a further 2 points sicker and I can't see it recovering yet. Perhaps a 'dead cat bounce' but people will short the 20.00 area - gap resistence - IF it ever gets back there any time soon. I see it entirely possible that it loses support at 12.21, based on the fact that it broke the weekly long-term channel with such force. It also lost volume by price support at $17.00 on a 3-year chart.

Comment

-

Comment