Our ETF Trading Strategy With New “Sell” Signal On Market Timing Model ($QQQ, $SPY)

After the major indices began pulling back from their highs in late September, then subsequently bounced in the beginning of October, our disciplined, rule-based market timing system shifted from “confirmed buy” mode to “neutral” mode on October 5. This change in our market bias perfectly coincided with the peak of the bounce off the lows of late September. In “neutral” mode, we can be positioned either long or short, but position size of all new trade entries will be lighter than usual, in order to reduce risk. Also, our portfolio will be primarily (or fully) in cash, with only a few positions in either direction.

As we entered into neutral mode on October 5, we exited all long positions in individual stocks and began focusing primarily on swing trading ETFs with a low correlation to the direction of the overall stock market (ie. currency, commodity, fixed income, and international ETFs). One week later, on October 12, the necessary signals were generated for a new “sell” signal (click here to review each of the five different modes of our timing model). The recent changes in our sentiment, based on our market timing system, are shown on the daily chart of the PowerShares QQQ Trust ($QQQ) below. Notice how the model is designed to keep you out of trouble when the going gets rough:

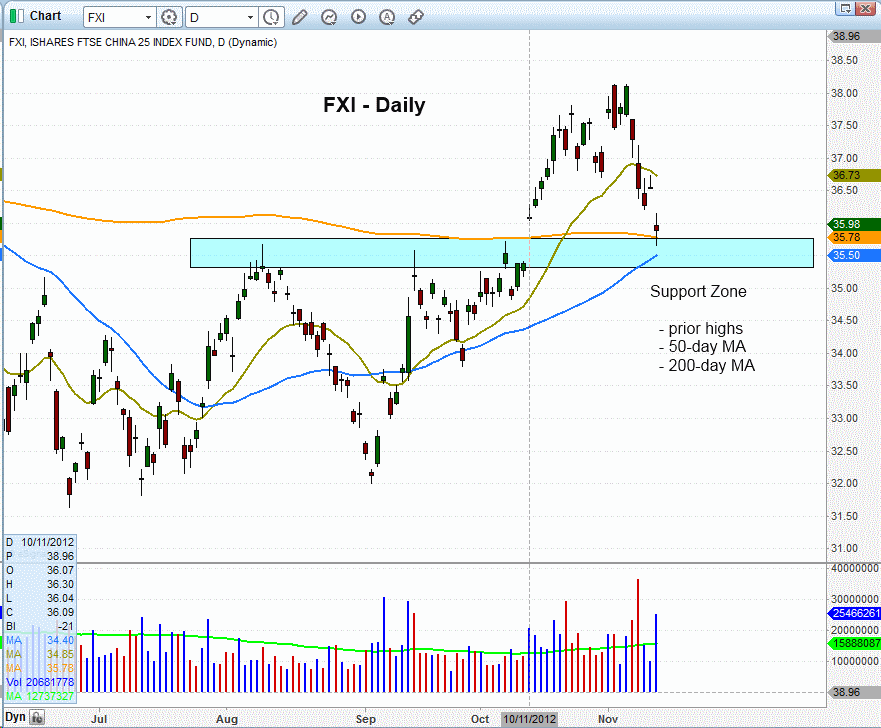

If we enter any individual stocks right now, the trades will be on the short side. But with ETFs, we have the choice of being short, buying an inversely correlated “short ETF,” or simply trading ETFs that are not correlated to the direction of the broad market. The latter is what we are doing right now. In addition to our three open positions, there are two new ETFs on our trading watchlist for potential entry in the coming days ($FXE and $SIL long). The technical setups of both these potential trades were discussed in the October 19 issue of our swing trading newsletter. Both of these ETF trade setups are low-risk ways to profit from weak market conditions for traders who are unable to sell short if they have a non-marginable cash account (such as an IRA).

Presently, we have three open ETF positions in our model ETF trading portfolio, each of which is showing an unrealized gain due to its low correlation to the direction of the broad market. US Natural Gas Fund ($UNG) is presently showing a 4.2% gain since our October 9 entry, FirstTrust Natural Gas Index ($FCG) is up 2.2% since entry, and our partial position of iShares Colombia Index ($GXG) is now trading 2.6% above our entry price. Since these ETFs have exhibited solid relative strength as the market sold off sharply over the past week, we anticipate further gains in the days ahead and will soon be raising our protective stops to lock in gains along the way.

In last Friday’s commentary, we said, “We can’t expect much from the S&P 500 if the Nasdaq is not on board. Over the past few weeks, two key Nasdaq leadership stocks, GOOG and AAPL, have broken down below their 50-day moving averages. These leaders are being replaced this week by insurance and utility stocks….this is not the type of rotation that inspires confidence.” Given that AAPL declined another 3.7% in last Friday’s session, further deterioration in leading Nasdaq stocks indeed played a big role in the day’s sharp decline. We continue to expect further pressure on the broad market as long as leading tech stocks remain weak. This week, all eyes will be on the quarterly earnings report of AAPL, which is due to trumpet its latest results on Thursday after the close.

After the major indices began pulling back from their highs in late September, then subsequently bounced in the beginning of October, our disciplined, rule-based market timing system shifted from “confirmed buy” mode to “neutral” mode on October 5. This change in our market bias perfectly coincided with the peak of the bounce off the lows of late September. In “neutral” mode, we can be positioned either long or short, but position size of all new trade entries will be lighter than usual, in order to reduce risk. Also, our portfolio will be primarily (or fully) in cash, with only a few positions in either direction.

As we entered into neutral mode on October 5, we exited all long positions in individual stocks and began focusing primarily on swing trading ETFs with a low correlation to the direction of the overall stock market (ie. currency, commodity, fixed income, and international ETFs). One week later, on October 12, the necessary signals were generated for a new “sell” signal (click here to review each of the five different modes of our timing model). The recent changes in our sentiment, based on our market timing system, are shown on the daily chart of the PowerShares QQQ Trust ($QQQ) below. Notice how the model is designed to keep you out of trouble when the going gets rough:

If we enter any individual stocks right now, the trades will be on the short side. But with ETFs, we have the choice of being short, buying an inversely correlated “short ETF,” or simply trading ETFs that are not correlated to the direction of the broad market. The latter is what we are doing right now. In addition to our three open positions, there are two new ETFs on our trading watchlist for potential entry in the coming days ($FXE and $SIL long). The technical setups of both these potential trades were discussed in the October 19 issue of our swing trading newsletter. Both of these ETF trade setups are low-risk ways to profit from weak market conditions for traders who are unable to sell short if they have a non-marginable cash account (such as an IRA).

Presently, we have three open ETF positions in our model ETF trading portfolio, each of which is showing an unrealized gain due to its low correlation to the direction of the broad market. US Natural Gas Fund ($UNG) is presently showing a 4.2% gain since our October 9 entry, FirstTrust Natural Gas Index ($FCG) is up 2.2% since entry, and our partial position of iShares Colombia Index ($GXG) is now trading 2.6% above our entry price. Since these ETFs have exhibited solid relative strength as the market sold off sharply over the past week, we anticipate further gains in the days ahead and will soon be raising our protective stops to lock in gains along the way.

In last Friday’s commentary, we said, “We can’t expect much from the S&P 500 if the Nasdaq is not on board. Over the past few weeks, two key Nasdaq leadership stocks, GOOG and AAPL, have broken down below their 50-day moving averages. These leaders are being replaced this week by insurance and utility stocks….this is not the type of rotation that inspires confidence.” Given that AAPL declined another 3.7% in last Friday’s session, further deterioration in leading Nasdaq stocks indeed played a big role in the day’s sharp decline. We continue to expect further pressure on the broad market as long as leading tech stocks remain weak. This week, all eyes will be on the quarterly earnings report of AAPL, which is due to trumpet its latest results on Thursday after the close.

Comment