Why We Don’t Care If The Stock Market Is “Overbought” ($QQQ, $SPY, $DIA)

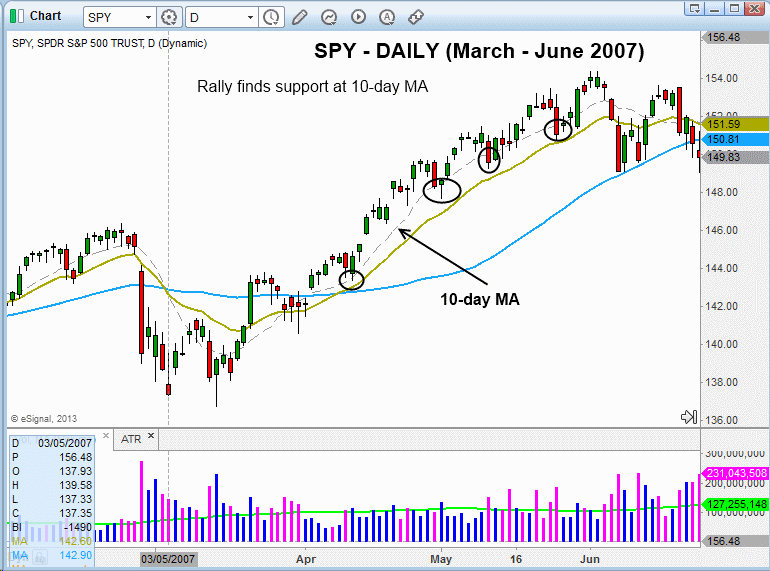

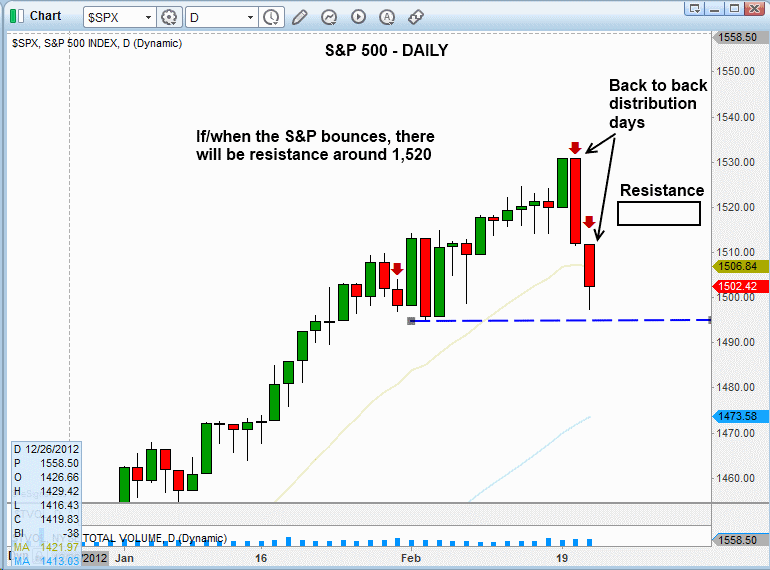

When a stock market is in runaway uptrend mode and refuses to pull back substantially, most investors and traders think, “I am not buying stocks at this level; I’ll just wait for a pullback.” Eventually that pullback will come, but often only after a multi-month advance has passed. This is why, in strongly uptrending markets, we find it much easier and more profitable to focus on the price action and technical patterns of individual leadership stocks and ETFs, rather than paying much attention to whether or not the charts of the S&P, Nasdaq, and Dow are “overbought” (we hate that useless term).

As long as there remains institutional rotation among leading stocks, with new breakouts continually emerging, the broad market will continue to push higher (although the major averages must also avoid significant distribution). That’s why “overbought” markets often become even more “overbought” than traders would expect before eventually entering into a substantial correction.

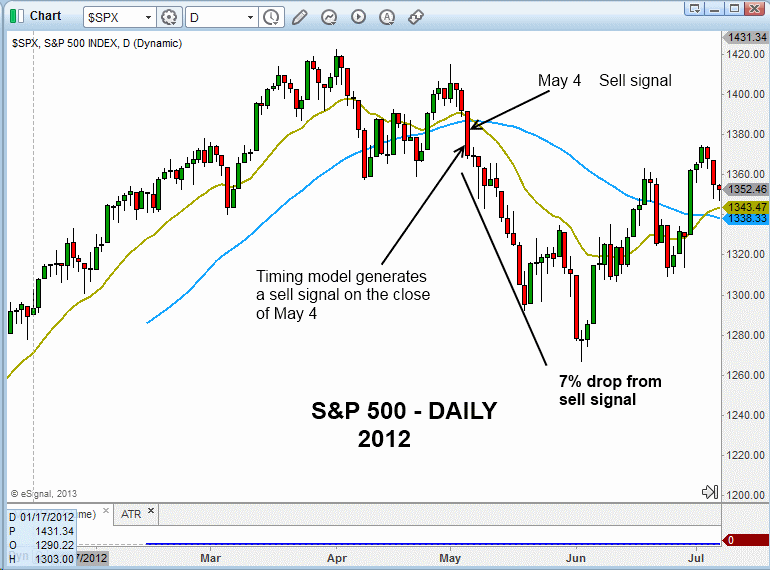

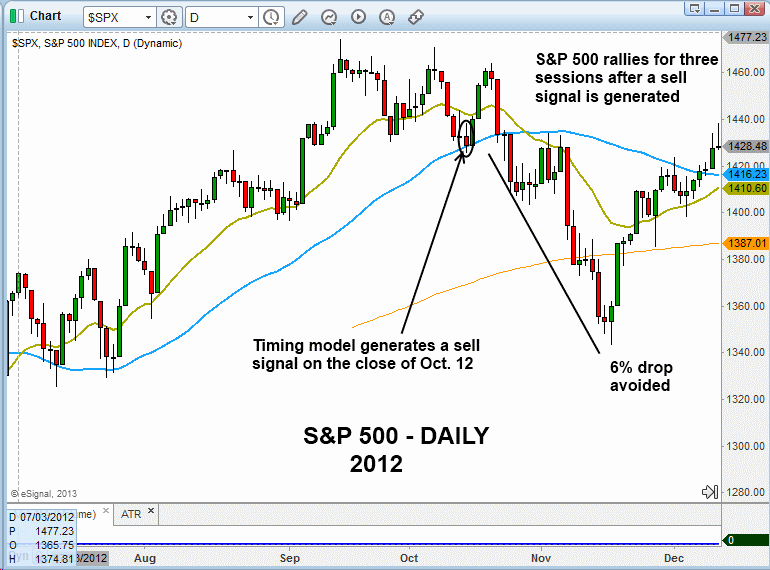

We are trend traders, so we simply follow the dominant trend as long as it remains intact. When the trend eventually reverses, our rule-based stock market timing system will prompt us to exit long positions and/or start selling short…and that’s just fine by us. We are equally content trading on either side of the market because being objective and as emotionless as possible is a key element of successful swing trading.

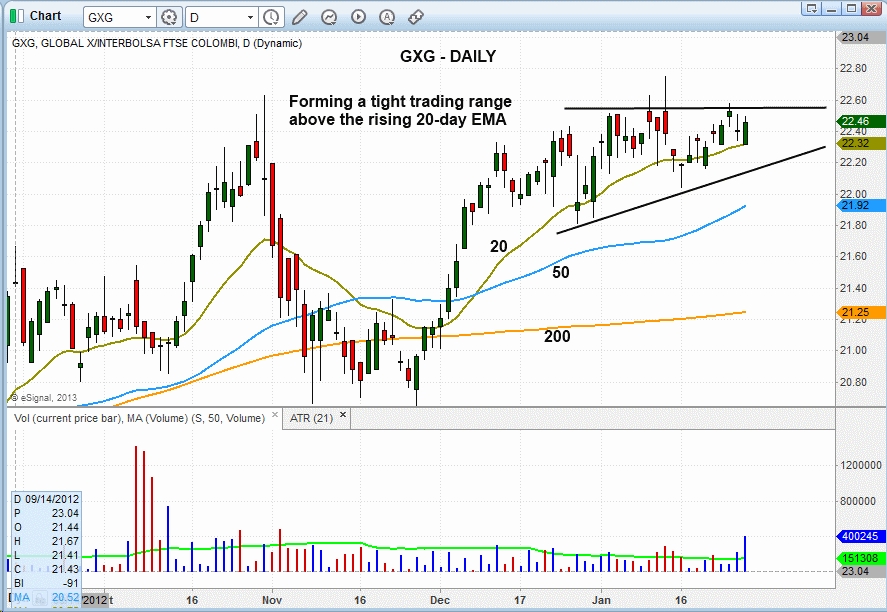

The majority of ETF positions presently in the Model ETF Portfolio of our end-of-day trading newsletter are international ETFs because they continue to show the most relative strength (compared to other ETFs in the domestic market). One of our open positions, Global X FTSE Colombia 20 ($GXG), has not yet moved much from our original buy entry point, but we like the current price action:

Since undergoing a false breakout on January 15, $GXG has pulled back to and held support of the 20-day exponential moving average (beige line on the chart above). In the process, it also formed a higher “swing low,” which is bullish. Notice that the price has also tightened up nicely since mid-December of 2012.

All of this means $GXG could finally be ready to break out above the $22.60 area. If it does, we plan to add to our existing position in The Wagner Daily swing trade newsletter. Regular subscribers should note our exact buy trigger and adjusted stop price for the additional shares of $GXG in the ETF Watchlist section of today’s report.

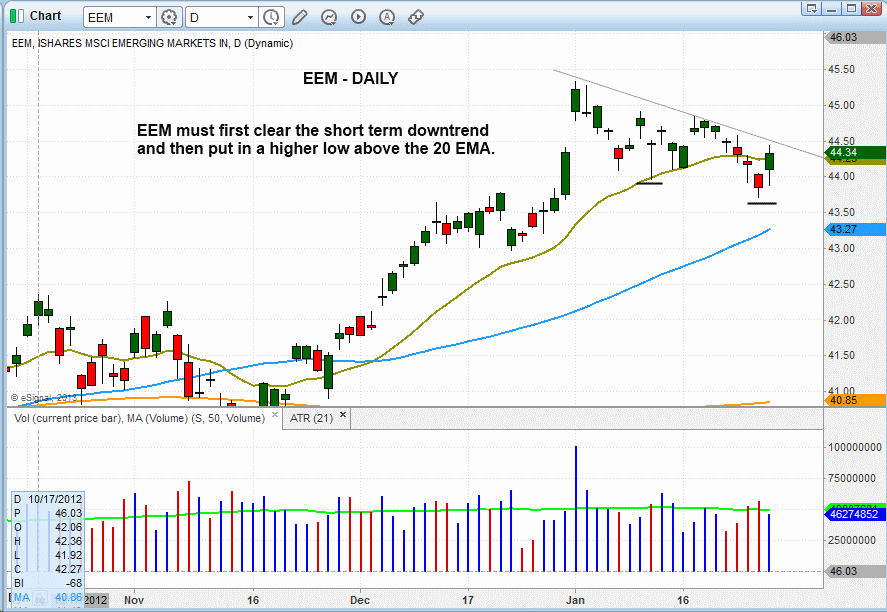

While on the theme of international ETFs, let’s take an updated look at the technical chart pattern of the diversified iShares MSCI Emerging Markets Index ($EEM), which we initially mentioned last week as a potential buy setup if it made a higher “swing low” and held support of its 20-day exponential moving average:

Although the price of $EEM did not hold above the 20-day EMA, a quick dip (“undercut”) below that moving average, followed by a quick recovery back above it, would keep this bullish setup intact. Therefore, if $EEM can rally above the short-term downtrend line annotated on the chart above, and subsequently put in a “higher low,” we might be able to grab a low-risk buy entry point as early as next week. As always, we will keep subscribers updated if any action is taken on $EEM, or any other ETF with a buyable chart pattern that crosses our radar screen while doing our extensive nightly stock scanning.

When a stock market is in runaway uptrend mode and refuses to pull back substantially, most investors and traders think, “I am not buying stocks at this level; I’ll just wait for a pullback.” Eventually that pullback will come, but often only after a multi-month advance has passed. This is why, in strongly uptrending markets, we find it much easier and more profitable to focus on the price action and technical patterns of individual leadership stocks and ETFs, rather than paying much attention to whether or not the charts of the S&P, Nasdaq, and Dow are “overbought” (we hate that useless term).

As long as there remains institutional rotation among leading stocks, with new breakouts continually emerging, the broad market will continue to push higher (although the major averages must also avoid significant distribution). That’s why “overbought” markets often become even more “overbought” than traders would expect before eventually entering into a substantial correction.

We are trend traders, so we simply follow the dominant trend as long as it remains intact. When the trend eventually reverses, our rule-based stock market timing system will prompt us to exit long positions and/or start selling short…and that’s just fine by us. We are equally content trading on either side of the market because being objective and as emotionless as possible is a key element of successful swing trading.

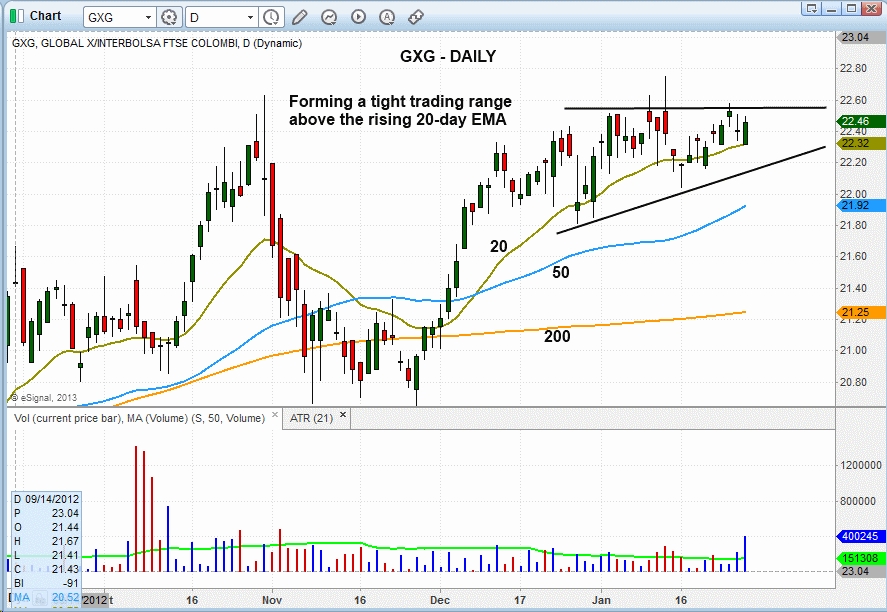

The majority of ETF positions presently in the Model ETF Portfolio of our end-of-day trading newsletter are international ETFs because they continue to show the most relative strength (compared to other ETFs in the domestic market). One of our open positions, Global X FTSE Colombia 20 ($GXG), has not yet moved much from our original buy entry point, but we like the current price action:

Since undergoing a false breakout on January 15, $GXG has pulled back to and held support of the 20-day exponential moving average (beige line on the chart above). In the process, it also formed a higher “swing low,” which is bullish. Notice that the price has also tightened up nicely since mid-December of 2012.

All of this means $GXG could finally be ready to break out above the $22.60 area. If it does, we plan to add to our existing position in The Wagner Daily swing trade newsletter. Regular subscribers should note our exact buy trigger and adjusted stop price for the additional shares of $GXG in the ETF Watchlist section of today’s report.

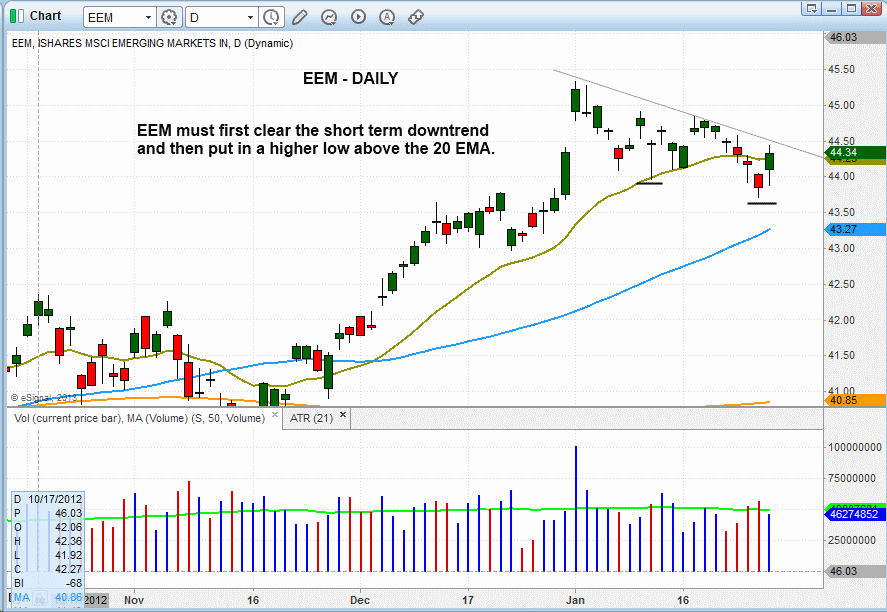

While on the theme of international ETFs, let’s take an updated look at the technical chart pattern of the diversified iShares MSCI Emerging Markets Index ($EEM), which we initially mentioned last week as a potential buy setup if it made a higher “swing low” and held support of its 20-day exponential moving average:

Although the price of $EEM did not hold above the 20-day EMA, a quick dip (“undercut”) below that moving average, followed by a quick recovery back above it, would keep this bullish setup intact. Therefore, if $EEM can rally above the short-term downtrend line annotated on the chart above, and subsequently put in a “higher low,” we might be able to grab a low-risk buy entry point as early as next week. As always, we will keep subscribers updated if any action is taken on $EEM, or any other ETF with a buyable chart pattern that crosses our radar screen while doing our extensive nightly stock scanning.

Comment