Why MagnaChip Semiconductor Corp ($MX) May Soon Explode Higher

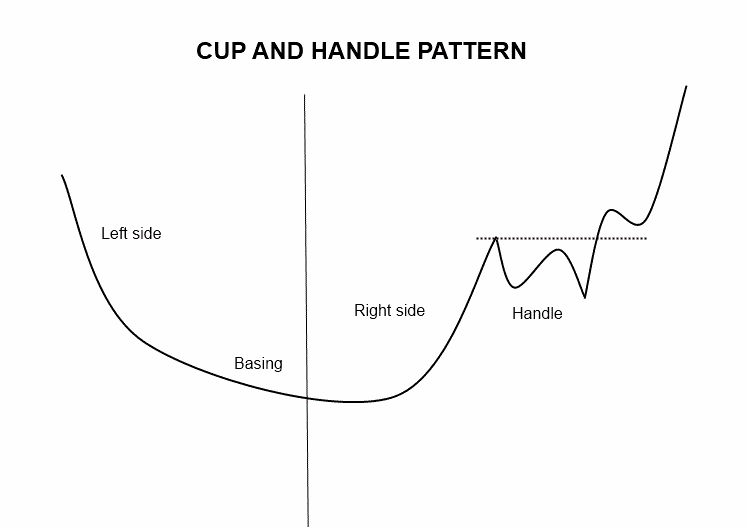

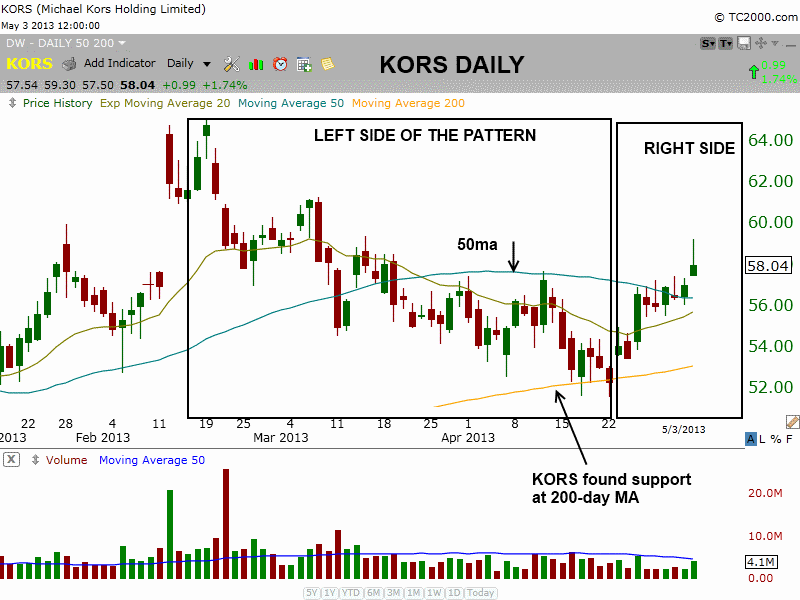

After a nasty shakeout from a false breakout in mid-February, MagnaChip Semiconductor Corp. ($MX) (which IPO’d in March 2011) has tightened up nicely above intermediate-term support of its 50-day moving average, and is holding above near-term support of its 20-day exponential moving average as well.

Big breakouts are typically preceded by a tightening of price action, which $MX is now exhibiting. The recent “false breakout” absorbed overhead supply, which should make it easier for $MX to surge higher after it breaks out above the high of its recent range. The technical swing trade setup for $MX is shown on the annotated daily chart below:

Although our stock picking strategy for swing trading is based primarily on technical trend following and market timing, we also incorporate certain elements of the popular and proven CANSLIM model into our stock selection process (although we tweak the indicators to be applicable for shorter holding periods than CANSLIM is intended for).

The IBD Relative Strength Ranking for $MX is very strong at 92, along with an equally strong EPS (earnings per share) ranking of 94. The earnings and revenues of $MX have ramped up over the past three quarters, and the ROE (return on equity) is at an impressive 35%. Furthermore, there has been a strong increase in fund sponsorship over the past 7 quarters, signaling that institutions want a piece. Finally, the IBD Industry Group rank is 20 out of 197 (stocks in the top 40 groups are ideal buy candidates).

As we have mentioned several times in recent weeks, the king of technical analysis is always price action (volume is queen). Therefore, until key leadership groups and stocks in the market start clearly breaking down, our bias must remain on the long side (albeit cautiously).

With that in mind, we have added several new individual stock and ETF buy setups, including $MX, to today’s “official” watchlist of The Wagner Daily stock picks newsletter. Regular subscribers should note our preset trigger, stop, and target prices for this $MX trade setup in today’s report, as well as several additional new stock and ETFs we are stalking for potential momentum trade entry.

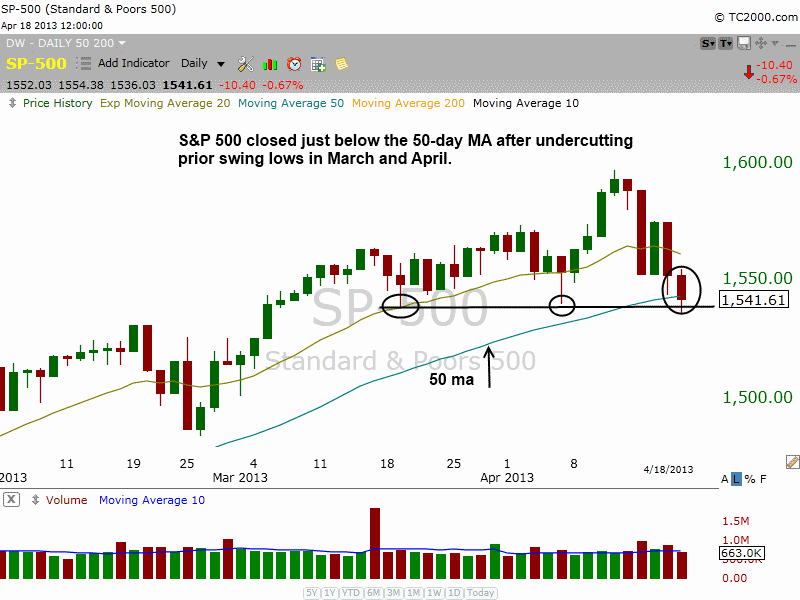

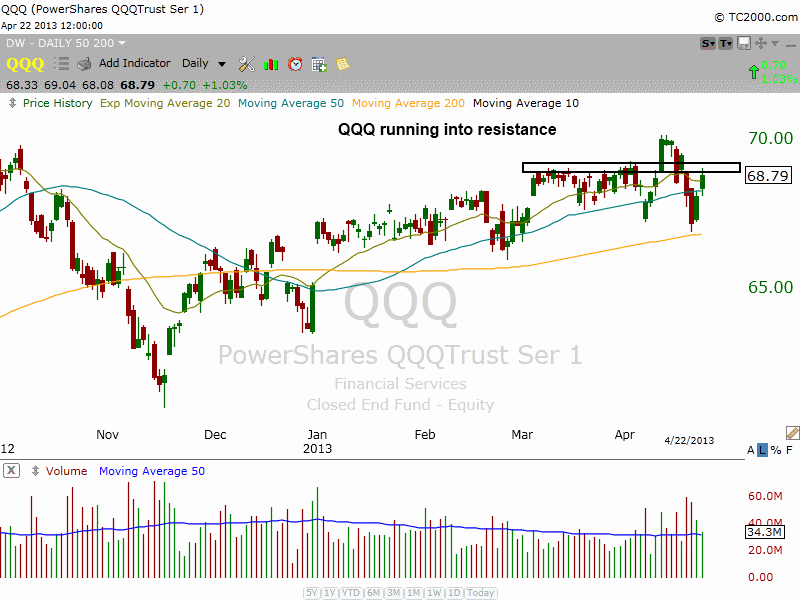

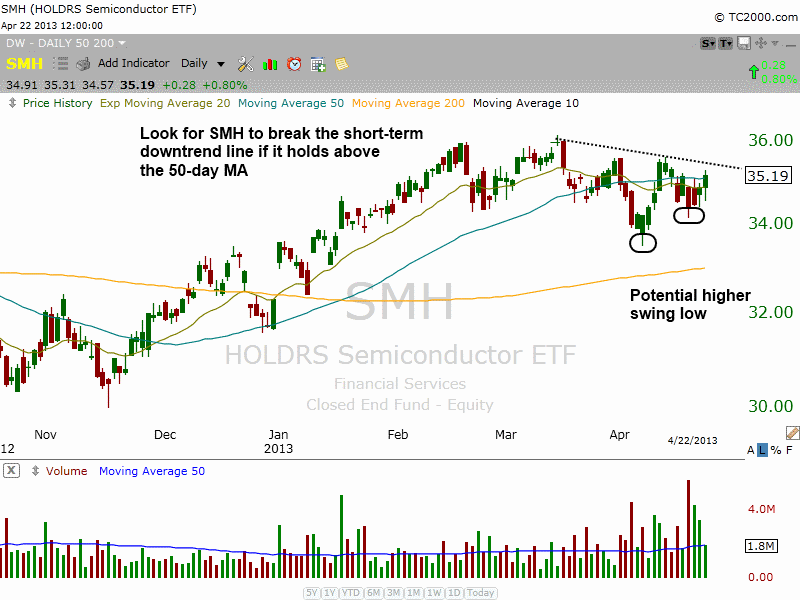

Navigating the stock market over the past few weeks has been challenging due to the mixed signals being received by our stock market timing model. However, don’t forget that price action is always king. For the moment, the market is holding up and new technical trade setups are emerging, both of which are bullish signs.

Although the stock market continues to advance on light volume, it’s tough to ignore the fact that chart patterns of many leading stocks still look good. Yes, we have seen a few market leaders break down, such as 3d Systems Corp ($DDD) or Ocwen Financial Group ($OCN), but the majority of leading individual stocks are still holding above their 50-day moving averages and trending higher (or forming bullish basing patterns).

After a nasty shakeout from a false breakout in mid-February, MagnaChip Semiconductor Corp. ($MX) (which IPO’d in March 2011) has tightened up nicely above intermediate-term support of its 50-day moving average, and is holding above near-term support of its 20-day exponential moving average as well.

Big breakouts are typically preceded by a tightening of price action, which $MX is now exhibiting. The recent “false breakout” absorbed overhead supply, which should make it easier for $MX to surge higher after it breaks out above the high of its recent range. The technical swing trade setup for $MX is shown on the annotated daily chart below:

Although our stock picking strategy for swing trading is based primarily on technical trend following and market timing, we also incorporate certain elements of the popular and proven CANSLIM model into our stock selection process (although we tweak the indicators to be applicable for shorter holding periods than CANSLIM is intended for).

The IBD Relative Strength Ranking for $MX is very strong at 92, along with an equally strong EPS (earnings per share) ranking of 94. The earnings and revenues of $MX have ramped up over the past three quarters, and the ROE (return on equity) is at an impressive 35%. Furthermore, there has been a strong increase in fund sponsorship over the past 7 quarters, signaling that institutions want a piece. Finally, the IBD Industry Group rank is 20 out of 197 (stocks in the top 40 groups are ideal buy candidates).

As we have mentioned several times in recent weeks, the king of technical analysis is always price action (volume is queen). Therefore, until key leadership groups and stocks in the market start clearly breaking down, our bias must remain on the long side (albeit cautiously).

With that in mind, we have added several new individual stock and ETF buy setups, including $MX, to today’s “official” watchlist of The Wagner Daily stock picks newsletter. Regular subscribers should note our preset trigger, stop, and target prices for this $MX trade setup in today’s report, as well as several additional new stock and ETFs we are stalking for potential momentum trade entry.

Navigating the stock market over the past few weeks has been challenging due to the mixed signals being received by our stock market timing model. However, don’t forget that price action is always king. For the moment, the market is holding up and new technical trade setups are emerging, both of which are bullish signs.

Although the stock market continues to advance on light volume, it’s tough to ignore the fact that chart patterns of many leading stocks still look good. Yes, we have seen a few market leaders break down, such as 3d Systems Corp ($DDD) or Ocwen Financial Group ($OCN), but the majority of leading individual stocks are still holding above their 50-day moving averages and trending higher (or forming bullish basing patterns).

Comment